Oil prices climb on Middle East tensions, US sanctions, China stimulus

BY MOTOLANI OSENI

Oil prices posted a weekly gain as geopolitical uncertainties and economic developments drove market sentiment. Escalating tensions in the Middle East, fresh US sanctions on Iranian crude exports, and China’s latest economic stimulus measures supported the bullish momentum.

Brent crude rose to $71.22 per barrel on Friday, marking a 1.4 per cent increase from last week’s closing price of $70.24. Similarly, West Texas Intermediate (WTI) gained 1.3 per cent to settle at $67.78 per barrel from the previous week’s $66.91.

The conflict in Yemen remained a key driver of market movement. The Houthi group reported that US warplanes conducted four new airstrikes in Yemen’s Al-Hudaydah province, a strategic coastal hub with vital ports. These strikes followed US President Donald Trump’s announcement of a ‘major attack’ against the Houthis last Saturday.

Houthi sources claim that intensified US airstrikes have resulted in 53 fatalities and over 100 injuries, including civilians. The renewed hostilities have heightened concerns over disruptions to global oil supply chains, particularly in the Red Sea and the Gulf of Aden.

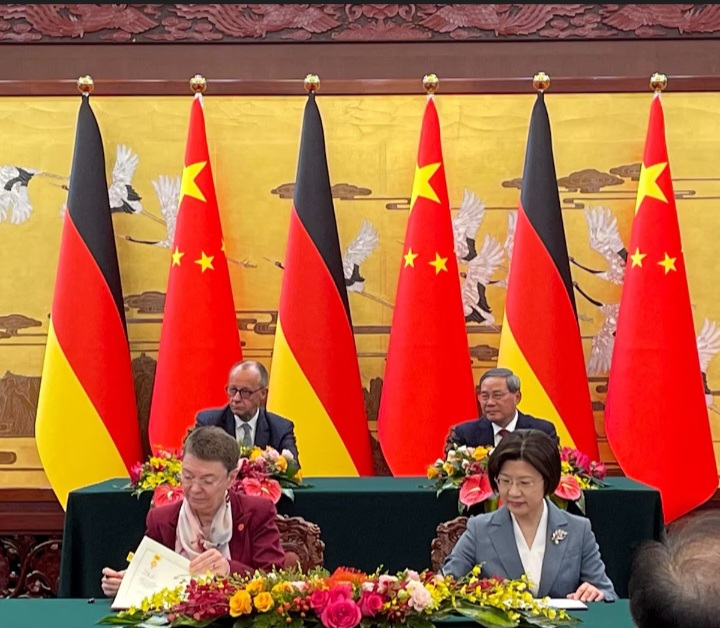

Adding to supply-side concerns, the US Treasury Department’s Office of Foreign Assets Control (OFAC) imposed new sanctions on entities involved in Iranian oil exports. The measures targeted a Chinese teapot refinery and its chief executive for purchasing and refining Iranian crude oil linked to the Iranian Ministry of Defence and the Houthi movement. Additionally, 19 entities and vessels associated with Iran’s ‘shadow fleet’ were blacklisted, along with a Chinese oil terminal accused of storing Iranian crude.

US Treasury Secretary Scott Bessent stated that these purchases provide “the primary economic lifeline for the Iranian regime, the world’s leading state sponsor of terror.” The sanctions added upward pressure on oil prices as market participants factored in potential disruptions to Iranian crude exports.

Meanwhile, expectations of stronger demand from China also lifted prices. Beijing unveiled a comprehensive stimulus package aimed at boosting domestic consumption, reinforcing optimism that crude demand will rise in the world’s largest oil-importing nation. Oil prices rallied in response, with Brent crude climbing 1.7 per cent to close at $72 per barrel, the highest level this month.

Additionally, OPEC+ announced a schedule to enforce oil output cuts through June 2026 to offset previous overproduction. Monthly cuts will range between 189,000 and 435,000 barrels per day (bpd), surpassing the anticipated supply increases set to begin in April. However, concerns remain over compliance, as several member nations have historically exceeded their production targets.

In contrast, US natural gas prices faced significant downward pressure. The front-month Henry Hub contract declined by 6.4 per cent after the Energy Information Administration (EIA) reported a higher-than-expected 9 billion cubic feet (bcf) increase in US natural gas storage. Despite this, overall storage levels remain tight at 1.71 trillion cubic feet, down 26.8 per cent year-on-year and 10 per cent below the five-year average.

Looking ahead, oil markets are expected to remain volatile, with geopolitical risks, US monetary policy decisions, and China’s economic trajectory playing crucial roles in shaping price movements.