NSE listing, transaction fees decline by 41%, 37% respectively

The Nigerian Stock Exchange (NSE) in its 2016 audited financial statement rereleased recently showed a decline in key performance indices, which conforms with state of the nation’s economy.

This was coming as cross section of market stakeholders have tipped demutualization of the exchange, and the emergence of new council president , as major issues to attract renewed interest and attention at its forth coming Annual General Meeting scheduled for 25th September,2017.

The President of the Exchange, Mr. Aigboje Aig-Imoukhuede in his statement in the annual report, announced the conclusion of his tenure as President at the local bourse “As I conclude my tenure as President of the National Council of the Nigerian Stock Exchange, it is with a great sense of humility and fulfilment that I reflect upon three memorable and fulfilling years of service in this prestigious role.”

Meanwhile, cross section of stakeholders have urged the NSE to live up to the standard set for listed companies by being among early filers and holding its AGM on time.

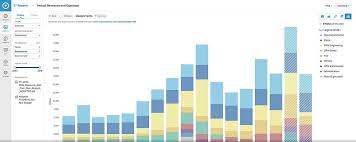

The Self-regulatory Organization’s (SRO) result for the 2016 audited financial statement which reflected apathy of investors and issuers in the market showed that earnings from new listing, listing fees declined by 41 percent to N813 million, while transaction fees, , major source of income for the bourse also depressed to N1.63 billion, reflecting 37 per cent decline.

The result further showed that the group posted 33 per cent drop in total income to N4.46 billion for the year ended 31st December, 2016 even as The Exchange’s made a profit after tax of N27.45 million for the review period.

The NSE Chief Executive Officer (CEO), Mr. Oscar Onyeama, noted that the NSE Group demonstrated resilience through the economic and market downturn.

He said that the projected exit from recession in 2017 by IMF, will provide more growth opportunities for the economy and the market.

“This projection presents a positive outlook for the NSE in the coming year, as we anticipate the reallocation of assets to the frontier and emerging markets.

He, however hinged any potential market rebound is critically dependent on the ability of government and regulators to implement policies that provide stability to the marketplace and enhance investor confidence.”

The NSE, CEO said that the Group total income declined 33 per cent to N4.46 billion , reflected investors’ reaction to prolonged macroeconomic uncertainty.

For the Exchange, he said, “Top line income streams were impacted during the year, being transaction fees which fell 37 per cent to N1.63bn, and listing fees which declined by 41 per cent to N813 million.

“This culminated in a negative year-end performance for The Exchange of N599m.

Stories by Bonny Amadi