Why banks’ lending to agriculture weakens

As the nation looks up to increased liquidity as the political landscape conditions for the 2019 general lections, agriculture sector may further suffer as expected liquidity inflow may not be extended the lift food production.

This may be a shortfall from the portfolio investments that enterd the country in 2017, out of which the manufacturing sector was not able to attract part of the funds.

Declining support to the Nigerian agricultural sector, opportunities may be closing gradually to the sector for the envisaged boost in agribusiness and food sufficiency, one of the main concerns of the federal government.

The development , which gives cause for concern, may not be unconnected with prevailing new approach to agriculture by financial institutions which tilts more to agricultural value chains, against mainstream agriculture.

This further tend to reflect interpretations by the deposit money banks of government’s avowed commitment to supporting agriculture , but with significant decline by N35 billion in support to agriculture, lender banks may have demonstrated resolve for stronger commitment to the sector by the government.

The national Bureau of Statics (BNS) recently released analysis on deposit money banks’ credit to the agriculture sector between October 2016 and September 2017 recently released showed a decline by N34.45bn, which shows a divergent movement from federal government’s focus.

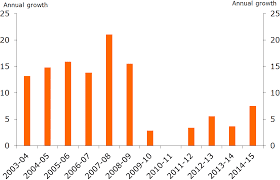

The Federal Government’s commitment to agriculture entails pursuit of agricultural promotion policies to enable the sector record an average annual growth rate of 6.92 per cent between 2017 and 2020, but would all these boost banking lending to the sector in 2018?

In order to achieve this, a lot of strategies have been outlined. Some of them are boosting productivity in the crop and other sub -sectors, including fisheries, forestry and livestock; integrating the value chain; and improving access to market.

The government also went further to introduce the Nigerian Incentive Based Risk Sharing for Agricultural Lending through sufficient and timely funding and expansion of the use of dams for commercial farming and aqua culture, all aimed at de-risking agricultural lending.

The Central Bank of Nigeria (CBN) under the Nigerian Incentive-Based Risk Sharing in Agricultural Lending (NIRSAL), approved disbursement of about N75bn as loan to farmers in the 36 states and the Federal Capital Territory (FCT).

The Ministry of agriculture in its effort to demonstrate the inherent forex earning opportunities in agriculture through yam production, of which Nigeria prides as global highest producer, recently embarked on the export of the product to the United States.

Investigation shows that controversy has trailed most of government’s initiatives to drive agriculture, including the Anchor borrowers’ scheme and the yam export to the US.

Could this be one of the reasons banks are reducing lending to the sector, or purely driven by poor operating environment occasioned by now, higher risk toga attached to lending to the sector.

While some farmers accuse the federal government of making the NISRAL funds out of reach of core farmers but for political apologists, others say that their effort to access the funds has remained frustrating and unsuccessful.

This development, according to an expert who spoke on condition of anonymity “may have forced the deposit money banks to further put in place, more stringent measures to protect the funds which they would be made to account for at the end” and this lead to reduced lending.

The none assessment of NISRAL funds by farmers, re-echoed in June 2017 at a seminar for farmers and SMEs in Abeokuta, Ogun State, when some farmer participants complained about difficulties in accessing loans as well as high cost of borrowing, including other bottlenecks.

Senior Manager, Development Finance Department, CBN, Dr. Xavier Okon, recognizing the lull in accusing the loan and the need to quickly disburse the funds to farmers in order to make the expected impact in the economy, explained that the apex bank is poised to helps solve the problems most businesses face in Nigeria , especially that of long-term financing needs which commercial banks cannot meet because their funds are mainly short term in nature.

Furthermore, while the ministry of agriculture, said that it successfully exported containers of yam to the UK and the US, there were counter reports that the experiment was successful as the yams were returned back as they failed to meet the standard of the target countries, hence they were spoilt on transit.

This, the ministry of agriculture has continued to defend, even when Nigerians are expecting for another round of export t support that the first export was successful.

Reacting on the yam export, Nigeria’s minister of agriculture, Chief Audu Ogbe said “In the ministry of agriculture, we are not exporters. The ministry does not export. We’re going to talk to the port authority on cooling vans for vegetables and fresh produce so that exporters don’t lose money and we don’t lose face. We should begin to build cold trucks that are temperature-controlled to keep the yams till the time they have to go. We should invest in special containers for their storage.”

While the controversy surrounding yam export and NISRAL fund lending, have their impacts on perception of government’s commitment to its avowed policy of boosting agriculture, the unending destruction of farmlands and slaughtering of farmers by terror laden herdsmen armed with AK47 rifles , may have further sent a wrong signal to the deposit money banks.

This was even as the Senior Special Adviser on Media to the Minister of Agriculture and Rural Development, Dr. Kayode Oyeleye, who represented the Minister of Agriculture, Chief Audu Ogbe, at a function in Lagos gave reasons on why herdsmen graze their cows.

Kayode, who spoke at the forum on the theme :“The journey of agriculture development in the country so far”, used the opportunity to educate the public on why herdsmen go all out to find areas with grass for their cattle to graze, thereby clashing with farmers over damaging of crops by cattle.

He debunked what he termed the popular belief that herdsmen attack only farmers in the southern part of the country is false, adding that it is the media that has made people believe so, which he said that the northern also been attacked by the herdsmen that are not reported.

“Grazing is more of reality. Many lands are being taken over by deforestation and erosion. Because of this, herdsmen go extra miles to find food (grazing grass) for their stock. They protect their animals from being attacked and stolen. Animals also stray into farms without the herdsmen knowing.

“Many communities in the north also experience attack from herdsmen over their farms being damaged by cattle. Most of these herdsmen are not even Nigerians. Many are from the neighbouring countries like Chad, Niger, Cameroun, and Mali,” he said.

Against the background of incessant attacks of farmers by herdsmen, Kayode said that an agency, called Agro Rangers, has been put in place to check the excesses of herdsmen.

Interestingly, with the agro rangers in Place, Benue state government on Friday carried out mass burial of 72 people most of whom were farmers, killed by herdsmen in recent attack, a development that has made government to start tinkering with introducing cattle colonies.

Considering that all these are tied to agribusiness, pay further paint clearer picture on why lenders are taking government promises on the sector with a pinch of salt.

Akure, Ondo state farm owner, Justice Michael Owoyemi whose farm was among the over 200 hectares of farmland destroyed by herdsmen recently disclosed that millions of Naira were lost to the destruction of their farms.

The farmer and serving Customary Court of Appeal Judge in the state, Owoyemi, lamented the incessant invasion of their farms by the herdsmen, tracing the genesis of the carnage on their farms and crops to the invasion to December 2016, when the herdsmen harvested most of the farm produce during the Christmas /New Year break.

The divergent songs by the government, ministry of agriculture on agriculture development and rampaging herdsmen poise to continually pillage farmlands and sniff lives out of farmers, possibility of increase in lending to the sector this year may remain slim.

This points to probable low business volume in the sector with attendant low production further challenging food sufficiency.

Bonny Amadi