Economic recovery pushes equities market to 11.3% MTD return

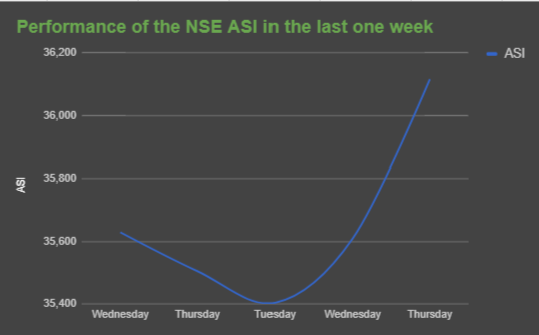

The Nigerian equities market sustained the bullish momentum for the third consecutive week, with the Nigerian Stock Exchange (NSE) All -Share Index (ASI) advancing further by 8.36 per cent for the week ended 28th July, 2017.

The ASI which closed at 36,864.71 points also reached a new year high and recorded its highest since November 2014 – thus increasing the Month- to- Date (MTD) and Year to Date (YTD) returns to 11.31 per cent and 37.17 per cent, respectively.

Giving insights into the growth recorded in the equities market recently, The Managing Director of Hycap Securities (A stockbroking firm), David Adonri in a chat with Daily Times at the weekend, said the month to date growth of almost 12 percent shows the equities market is bouncing back from a long period of inactivity.

“The factors that have driven the market so far shows the economy has been recovering from stagflation. Generally, when there is an economic crisis, financial assets migrate from equities to fixed income, but when the economy is recovering from the crisis the direction will reverse and financial assets will then flow from fixed income to equities. So that is a major factor that is propelling the recovery of the equities market” he said

Speaking further, Adonri noted that, The CBN came up with a monetary policy that gave a foreign exchange window to exporters and foreign portfolio investors which increased foreign investors’ confidence in the economy and facilitated their re-entry into the equities market.

He said that the increase in equities market activities may also be as a result of Pension Fund Administrator’s (PFA’s) increasing their portfolios in the equities market, having seen the direction of the economy and will like to position themselves quite early now that most of the stocks are undervalued, so that by the time the economy recovers fully they will be well positioned and will realize good profit.

He noted that some of the second quarter reports that were also impressive contributed to the increased demand for equities.

During the week, activity was broadly strong as the market closed positive on most of the trading sessions – save for Friday when the market lost 1.02 per cent due to the selloffs in the Industrial Goods, Oil & Gas and Insurance indices to outweigh the gains in the Banking and Consumer Goods indices.

Performance across sectors was also bullish with all sector indices appreciating 5.60% on average.

Investors’ interest in the Banking sector persisted during the week, as the news of approval of interim dividends by the Boards of Tier 1 banks continued to stoke appetite while positioning ahead of earnings releases by Dangote Cement, Nestle, Dangote Sugar and Nigerian Breweries lifted the Industrial and Consumer Goods indices.

Conoil with a growth of 21.41 percent to close at N36.40 per share led 51 equities that appreciated in price during the week, higher than 36 equities of the previous week.

Cadbury, with a decline of 18.17 per cent to close at N10.45, led 23 equities that depreciated in price, lower than 33 equities of the previous week, while 97 equities remained unchanged lower than 102 equities recorded in the preceding week.

The total volume traded by investors was 2.211 billion shares worth N30.636b in 26,287 deals. This is in contrast to a total of 3.628 billion shares valued at N34.886 billion that exchanged hands last week in 19,834 deals.

The week’s performance consequently led to an appreciation of N980.3b in the market capitalization that closed at N12.705 trn.