When companies are open for hostile acquisition

Mr. Malomo Oladapo a Lagos -based stockbroker told our correspondent that having seen the first week of trying the new pricing methodology, the best form of insurance for the insurance firms on the expected development rests on the boards themselves.

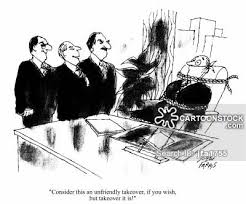

The boards of insurance companies should race up with reality and perform better to deliver value to shareholders; otherwise investors who have money and are committed to deliver value to shareholders may wrestle the companies from them at 1 kobo per share.

The trend has its positive impacts, which certainly will subdue whatever negative impact that people might see in the new pricing model.

He said that consideration on investment should above all place greater emphasis on shareholders who usually are denied of any benefit as long as companies remain unprofitable and in most cases, continue to trade at par value price of 50 kobo per share.

On 29 January 2018, the Nigerian Stock Exchange (NSE) introduced new pricing methodology, which ushered in three categories of listed companies and how their equity prices should move either up or down. The week ended February 28,th 2018, marked the second week of the new price regime operation.

The three categories in the new price regime are companies trading at N100 and above, companies trading at N50 and above and those trading at N.50 and above.

To move the share price of companies in category A by N10.00 you need to pull a turnover of 10,000 units of shares and above Category B requires 50,000 units of shares and above to move he price by N5.00, while category C, where most of the insurance companies fall into requires 10,000 units of shares to move price here by N0.1 kobo.

Five days of experimenting the new pricing methodology has shown that most insurance companies are heading to eventually trade at 1 kobo per share, having removed the ceiling on per value pricing of 50 kobo per share.

This unfolding trend reinforces the fear expressed in many quarters that unless there is a stringent effort by the insurance sector regulators, most of the companies listed may be forcefully acquired through a new pricing regime that is bent to ridicule the poor performances and year -on -year unprofitable nature of most of the firms.

Is the likely to be a new form of insurance policy for the firms to save them from forceful acquisition, low equity pricing or poor performance by their respective boards? Many concerned have asked.

Findings show that at the end of the week’s trading, out of the 22 listed insurance companies that recorded price movement, 49 per cent commenced equity rice descent to I kobo, while some others consolidated at 50 kobo per share.

Some insurance companies commenced their price descent to 1 kobo from 50- kobo former par value price ceiling are LASACO which closed the week at 0.36kobo per share, African Alliance Insurance Company closed at 0.42 kobo while Unity Kapital Insurance closed at 0.46 Kobo per share.

UNIC insurance closed at 0.46kobo, Cornerstone Insurance Company closed at 0.47kobo while Sovereign Trust Insurance closed at 0.48kobo,

Prestige Assurance closed at 0.48 kobo per share, Mutual benefit closed the week at 0.48 per share, while Hall Mark Insurance also closed the week below 50 kobo, at 48 obo per share.

Oladapo mentioned earlier, however added that what should be considered in the fate of the insurance companies should be the stakeholders, as according to him, all the stakeholders in the companies that have been declaring loss year on year , receive their benefits, yet the shareholders are denied dividend, because loss making companies don’t pay dividend.

He said, UI“Look at the stakeholders, the government collects their tax, creditor collects their cash, staffs are paid, and contributors have been collecting their dividend except the shareholders”.

Speaking in the same manner, another Lagos -based stockbroker, Mr. Solomon Kugbe said that he new pricing model certainly will check none performing companies and the possibility of new owners emerging through right pricing.

“Some of these companies that traded at 50 kobo have been trading below 50 kobo over the counter, now the door has been opened for anyone who wants to trade his/her shares at below 60 kobo on the floor”.He said.

According to him, the owners of the none performing insurance companies should either sit up or they are asked to leave by new investors who may want to generate value after buying majority shares of the firms, however he ruled out forced acquisition.

It will be recalled that some o the insurance companies have corporate governance challenges of which their various stakeholders have written to the national assembly t conduct forensic audit on their five years accounts to determine their true financial position.

The Nigerian House of Representatives subcommittee on capital market and other institutions in November 2017, summoned over 100 companies for explanations on corporate governance’s breach allegations against them.

The invitation and the drama that has continued to unfold following the House summon, , reinforces stand of some stakeholders that some listed companies have continued to defraud shareholders even trading at cheap price or year on year loss position.

In some cases companies have been alleged to be declaring losses either to beat payment of profit tax or further payment to shareholders in terms of dividend, just as they continue to meet their other obligations to the latter.

Indicating the stand of insurance companies in giving value to shareholders, majority of the companies invited by the House of Representatives, were insurance firms, that have continued to trade at par value of 50 kobo per share an declaring loss year on year.

Consolidated Hallmark Insurance, Continental Reinsurance, Cornerstone insurance company, Custodian and Allied Insurance

Others are Goldlink Insurance, Great NIGERIA insurance PLC, African Alliance Insurance Company, Afrinsure Financial Services, AIICO Insurance, Axamansard Insurance company ,among others.

It would be recalled that the summon by the committee was based upon petitions by stakeholder referred it for further legislative action.

Through the summon, the house subcommittee chaired by Honorable Tony Nwulu, also signatory to the invitation letters to the companies CEO’s, is looking into the allegations.

He said,“ as you may wish to recall, we have of recently written to request for relevant information on public liability companies as it relates to their five year audited reports, corporate governance and shareholdings compositions”.

Arising from the above, the responses from shareholders and he investing public, we have received complaints and petitions against your board, same copied to the Securities and Exchange Commission (SEC) and the Economic and financial crime commission (EFCC) in the last 18 months allegedly without any satisfactory action taken to deal with the matters raised in the petition’.

In the House committee letter to the board of the over 100 companies , the investigating committee requested the companies to furnish them with their own defenses to the allegation raised by shareholders and other stakeholders, however, it was learnt that some of the companies rushed to the court to stop further investigation into their affairs by the House.

Bonny Amadi