A lot of people do not have the wealth mindset – Entrepreneurs

Abuja – Some entrepreneurs on Saturday in Abuja advised the youth against what they called, “Make it Quick” syndrome.

They gave the advise at the second edition of a seminar organised by Hidden Wealth Academy, an organisation with the vision of helping youths to create sustainable wealth in businesses.

While acknowledging the need for youths to be engaged, the entrepreneurs kicked against youths engaging in questionable practices in their quest to get rich quick.

They called on youths to change such mindset, saying wealth could be created from genuine ventures through consistency, tenacity and focus.

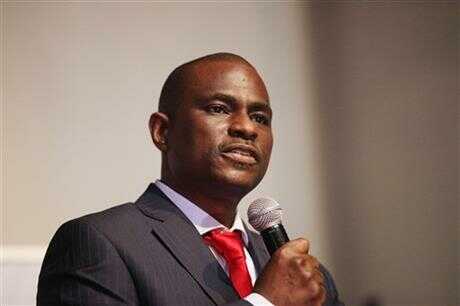

The convener of the seminar, Mr Yemi Ajala, lamented that most youths did not have the mindset to create wealth.

He advised that rather than engaging in dubious and unsustainable acts that would make them rich within a short time, they should learn from the rich by changing their mindset.

Bobrisky poses serious health hazard to Nigerian youths — Runsewe

Ajala, who is the founder of the academy, said , “the purpose of the platform is to raise wealth creators. Our main objective is to ensure that we elevate and improve the financial well being of millions of Nigerians.

“We are starting in this manner to create awareness that there are opportunities that people can explore from wherever they are, in order to create wealth.

“One of the things I have discovered by studying the rich is that it is not just about the money you have to start a business that matters.

“Becoming wealthy is more of a mindset. It is 10 per cent strategies and 90 per cent mindset. I have discovered that a lot of people do not have the wealth mindset.

“By the time we did mindset quotient on people, we discover that majority of the people actually are in the poor zone,” he said.

He further said, “they have a mindset that cannot attract wealth. I have been privileged to speak in organisations to tell them about how to create wealth.

“Anytime I try to interview people, I discover that majority are with the low wealth mindset.

“If you do not have the wealth mindset you cannot create wealth. If you have opportunities and you do not have the right mindset, you will not not succeed.

“What we are doing is that we are revealing to people, the knowledge of opportunities around them that they can take advantage of. We have done the first edition this is the second edition,” the convener said.

On creating enabling environment for small and medium enterprises to thrive, Ajala commended the Federal Government for efforts made in that direction.

He, however, called for more assistance from government, saying, all that the youths required was infrastructure, soft loans and other relevant things to become employers of labour.

He said, “looking at the business environment, a lot of things have changed but we are not yet there because you still discover that people still need capital to start businesses.

“If you ask the youths today what is your number one problem or your number one business challenge, it is still about capital.

“Although a lot of opportunities have come up that government gave grants and all of that.

“We have more than 50 million youths in Nigeria. If you are able to give grants to about 20,000 people, you have tried but you have not solved the problem.

“So, we still need government to provide enabling environment for businesses to start and for business to thrive in Nigeria.

“No doubt government is trying to ensure that youths start businesses, at the same time there are regulations that are stiffening, that are not making it very easy for the youths.”

Mr Adewale Aladejana, Chief Executive Officer of Saphhire Group of Companies, advised youths to study the acceptability of business opportunities before going into them.

He also advised the youths not to despise the days of little beginning, adding that with dedication, they would break through.

“Tailor your business to the specific needs of the people. For instance, you cannot be selling raincoat in a country where it doesn’t rain. It is adaptability that matters.

“You must not get it all before starting. For instance, from the beginning, all I had was N30,000. If I hadn’t started I may not have gotten to where I am today.

“So, I tell people to start with what you have, where you are and if you are good at it other doors will open.

“You did not grow up in one day. So, how do you feel that you are going to blow overnight. It takes consistency, hard work, tenacity and passion,” he said.

Aladejana called on government at all levels to intensify efforts at providing more business friendly funds to small businesses.

Mrs Titi Ojo, Executive Director of A-PLUS Trainers, who spoke on funding for small and growing businesses, said most small and medium enterprises were not accessing funds from financial institutions because they did not have structure.

While advising that businesses which planned to access credit facilities should have what she called “the five C’s of credit”, which are capital, collateral, conditions, capacity and character, Ojo urged them to also explore other sources of funding.

She said, “there are loans everywhere. Money is there, bank is there, of course businesses fund. Get external funding via equity.

“When we are talking about debt we are talking about money from the bank like commercial banks, development finance institutions and we have a couple of loans in that space.

“I talked about equity and equity will be what are you bringing to the business by yourself or are you getting those that can buy shares in your business to have an equity or are extending to venture capitalists that can fund part of your business or get investors.

“So, there are a couple of things like that.

“I talked about the five C’s of credit which every finance institution will look for. One is character, the second is capacity, the third is capital, the fourth is collateral the fifth is conditions. That has been the five C’s of credit for years now.

“The most important at the end of the day is character because, if you have good character, your credit history is good then there is an likelihood that that bank or that financial institution will consider servicing that loan request,” she said.(NAN)