US tariffs could lead to retaliatory measures from Nigeria – Okonji-Madu

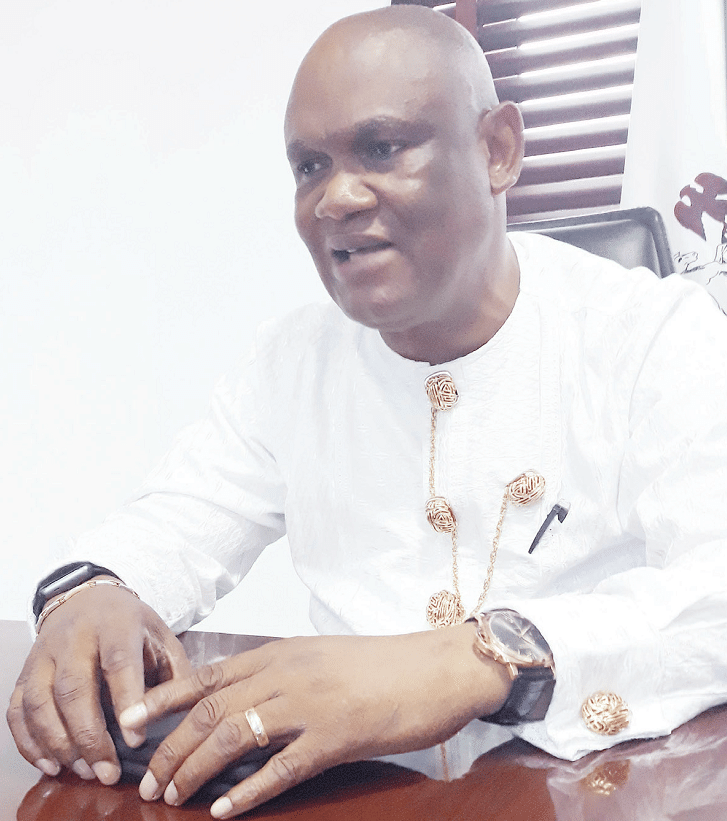

Dr (Barr.) Vivian Okonji-Madu is an Associate Professor of Law at the Nigerian Institute of Advanced Legal Studies, Abuja. However, she is currently on a sabbatical leave at the National Human Rights Commission also in Abuja. She spoke exclusively to Ag. Editor, Patrick Wemambu, on President Donald Trump’s new reactionary tariffs and their implications for world economy. Excerpts;

The Daily Times: Is it true the US is comparatively trade disadvantaged vis-a-viz nations slammed the tariffs?

Okonji-Madu: The US trade position varies by country, and some countries have more favorable trade balances with the US than others. Here’s a brief overview:

Countries with favorable trade balances: Some countries, like China, have significant trade surpluses with the US, meaning they export more to the US than they import.

Countries with unfavorable trade balances: Other countries, like Nigeria, have trade deficits with the US, meaning they import more from the US than they export.

In the case of Nigeria, the US has a trade deficit of $3.29 billion, with Nigerian exports to the US valued at $4.73 billion in 2023. The US imposed a 14% tariff on Nigerian exports, citing Nigeria’s 27% duty on US goods.

Comparative Trade Disadvantage.

US trade deficit: The US has a significant trade deficit with some countries, which can be a disadvantage.

Tariffs as a response: The US has imposed tariffs on some countries, including Nigeria, to address perceived unfair trade practices and reduce the trade deficit. Country-Specific Trade Relationships

China: The US has a significant trade deficit with China, which has been a point of contention in US-China trade relations.

European Union: The US has a trade deficit with the EU, but the relationship is more complex, with both sides having significant trade volumes. In summary, the US trade position varies by country, and some countries have more favorable trade balances with the US than others. The US has imposed tariffs on some countries to address perceived unfair trade practices and reduce the trade deficit.

The Daily Times: Trump accused countries of currency manipulation to gain unfair advantage over the US. Can you expatiate on this?

Okonji-Madu: Countries Accused of Currency Manipulation are:

1. China: The US has repeatedly accused China of manipulating its currency, the yuan, to maintain a competitive advantage.

2. Japan: Japan has been accused of intervening in currency markets to weaken the yen and boost exports.

3. South Korea: South Korea has been accused of manipulating its currency, the won, to maintain a competitive advantage.

Impact of Currency Manipulation

1. Trade imbalances: Currency manipulation can lead to trade imbalances, as countries with undervalued currencies may export more than they import.

2. Unfair competition: Currency manipulation can create unfair competition, as countries with undervalued currencies may have an advantage in international trade.

3. Economic instability: Currency manipulation can lead to economic instability, as it can create uncertainty and volatility in currency markets.

US Response to Currency Manipulation

1. Tariffs: The US has imposed tariffs on countries accused of currency manipulation, such as China.

2. Diplomatic pressure: The US has applied diplomatic pressure on countries accused of currency manipulation to reform their currency practices.

3. Multilateral agreements: The US has pursued multilateral agreements, such as the Trans-Pacific Partnership (TPP), to address currency manipulation and promote fair trade practices.

The Daily Times: Will the tariff policy engender a price war in the world?

Okonji-Madu: Trump’s tariff policy could lead to a price war in several ways:

Increased Costs for Consumers: The average tariff rate on all imports would rise from 2.5% to 16.5%, the highest since 1937. This increase would be passed on to consumers, reducing their purchasing power.

Reduced Imports: Tariffs would cause imports to fall by $800 billion in 2025, or 25%. This reduction could lead to shortages and higher prices for affected goods.

Retaliatory Tariffs: Countries like China, Canada, and the European Union have already imposed or threatened retaliatory tariffs, affecting $330 billion of US exports. This could escalate into a global trade war, driving up prices.

Potential Consequences

Inflation: Higher tariffs could lead to increased production costs, which may be passed on to consumers through higher prices.

Reduced Economic Growth: The tariffs could reduce US GDP by 0.7% to 0.8%, as well as decrease after-tax income by an average of 1.9%.

Trade Deficit: The tariffs might not effectively address the US trade deficit, as imports could decrease, but exports might also decline due to retaliatory measures.

Key Affected Sectors

Steel and Aluminum: Trump’s tariffs on these materials could increase costs for industries that rely heavily on them, such as construction and manufacturing.

Automotive: The 25% tariff on autos and certain auto parts could raise prices for consumers and reduce demand.

Agriculture: Retaliatory tariffs on US agricultural exports could harm farmers and the agricultural industry.

The Daily Times: Should Nigeria be agitated about its reactionary tariff? Give the low down. Are there consequences of the levies on Nigeria?

Okonji-Madu: The consequences of Trump’s reactionary tariffs on Nigeria are significant, affecting the country’s economy and trade relationships. Here are some key impacts:

Economic Consequences

14% Tariff on Nigerian Exports: The US has imposed a 14% tariff on Nigerian exports, mirroring the 27% duty Nigeria imposes on US goods. This could make Nigerian products less competitive in the US market ¹.

Reduced Exports: Nigeria’s oil-dominated exports to the US have declined in recent years, and the new tariff could further reduce non-oil exports.

Trade Deficit: The US has a trade deficit of $3.29 billion with Nigeria, and the tariffs could exacerbate this imbalance.

Sector-Specific Impacts

Petroleum Industry: The tariffs could affect Nigeria’s petroleum exports, which accounted for $4.73 billion in 2023.

Agricultural Sector: The US is Nigeria’s largest export market for agricultural products, and the tariffs could reduce demand for Nigerian agricultural goods.

African Growth and Opportunity Act (AGOA): The tariffs threaten key trade preferences under AGOA, which provides African nations with preferential access to the US market.

Global Trade Relations: The US tariffs could lead to retaliatory measures from Nigeria and other affected countries, potentially escalating into a global trade war.