FG finalises N4 trillion bond plan to settle GenCos, gas suppliers’ debts

The Federal Government has finalised the implementation framework for a N4 trillion government-backed bond designed to settle verified arrears owed to power Generation Companies (GenCos) and gas suppliers.

This was disclosed by Mrs Olu Verheijen, Special Adviser to the President on Energy, in a statement posted on X (formerly Twitter) on Tuesday in Abuja.

According to the statement, the agreement was reached at a high-level meeting between federal government officials and senior executives of GenCos to review modalities for clearing the outstanding debts.

The meeting, the statement said, ended with a consensus on the next steps, including bilateral negotiations to finalise comprehensive settlement agreements that balance fiscal realities with the financial challenges facing the GenCos.

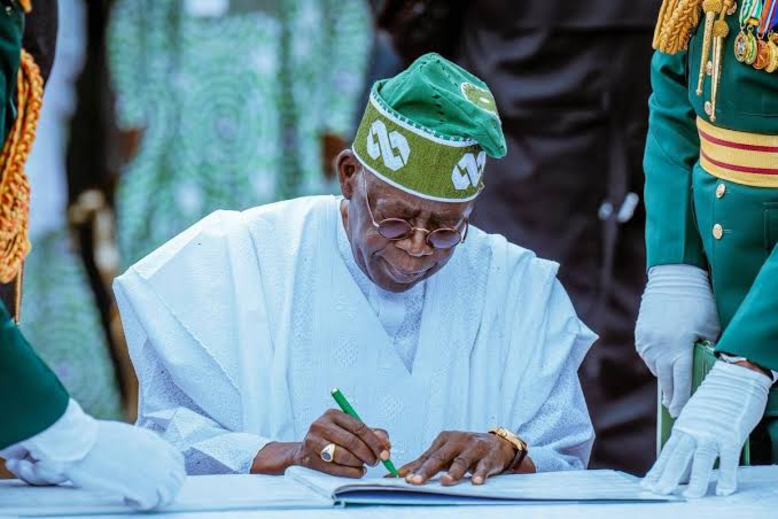

“Approved by President Tinubu and endorsed by the Federal Executive Council (FEC) in August 2025, the plan authorises the issuance of up to N4 trillion in government-backed bonds to settle verified arrears owed to generation companies and gas suppliers,” the statement noted.

“This intervention, the largest in over a decade, addresses a legacy debt overhang that has constrained investment, weakened utility balance sheets, and hindered reliable power delivery across the country.”

GenCo owners praised President Tinubu for what they described as a decisive move to resolve the power sector’s liquidity crisis.

Tony Elumelu, Chairman of Heirs Holdings and Transcorp Power, said: “For the first time in years, we are seeing a credible and systematic effort by government to tackle the root liquidity challenges in the power sector. We commend President Tinubu and his economic team for this bold and transformative step.”

Kola Adesina, Group Managing Director of Sahara Group, shared similar sentiments.

“This initiative is significant in every respect. It gives us renewed confidence in the reform process and a clear signal that the government is serious about building a sustainable power sector.”

Verheijen added that the intervention would also help close metering gaps, align tariffs with efficient costs, improve subsidy targeting for the poor and vulnerable, and restore regulatory trust.

“The sector is shifting from crisis response to sustained delivery and building the confidence needed to attract large-scale private capital,” she said.

Backstory

In July, President Bola Tinubu approved the N4 trillion bond initiative to address the liquidity shortfall in Nigeria’s power sector.

The decision followed a meeting between the president and representatives of GenCos at the Presidential Villa in Abuja, where Tinubu reaffirmed his administration’s commitment to resolving the financial challenges plaguing the sector.

He acknowledged the historical liabilities inherited from previous administrations and assured GenCos that his government would address the issue with transparency and fairness.

Verheijen attributed the liquidity crisis to “a combination of unfunded tariff shortfalls and market shortfalls” that had built up over a decade.

She revealed that as of April 2025, the Federal Government carried a verified exposure of N4 trillion in debts to GenCos — an accumulation dating back to 2015.