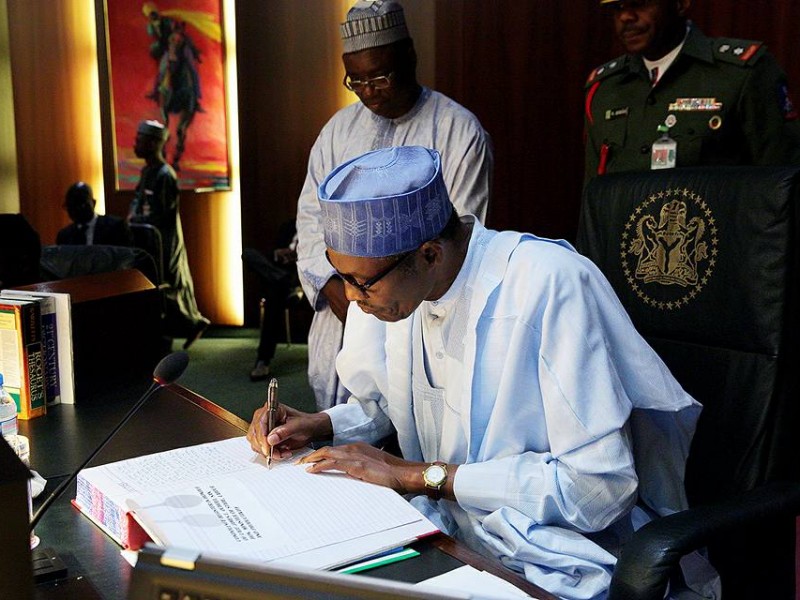

Bloomberg report knocks Buhari’s one year in office

Bloomberg, the popular business news agency, in a report has condemned the way President Muhammadu Buhari handled the affairs of Nigeria in the first one year of his administration, saying that under him, the Nigeria’s economy is on its knees. In its assessment, Bloomberg said President Buhari who took office as Nigeria’s president a year ago on a wave of optimism, failed to live up to expectation as Africa’s biggest economy is now on its knees.

Bloomberg quoted Malte Liewerscheidt, a Nigeria analyst at Bath, U.K.-based consultant Verisk Maplecroft as saying that under Buhari “it’s been a lost year. What’s missing is sound macroeconomic policies.” The business news agency said delays in approving the 2016 budget and constituting a cabinet as well as President Buhari’s refusal to weaken an overvalued currency, the Naira, until he hinted at relenting last week — have caused foreign investors to flee.

Foreign investors, fearing a devaluation, are staying away, the report stated. According to the report, foreign direct investment was the lowest last year since the 2007-08 global financial crisis, and Citigroup Inc. said deals have ground to a halt, adding that Capital controls prompted JPMorgan Chase & Co. in September last year to kick Nigeria out of its local-currency emerging-market bond indexes, tracked by more than $200 billion of funds. Bond losses in 2016, Nigeria’s local-bond yields have climbed 276 basis points to 13.46 percent, leaving them as the only such securities among 31 emerging markets tracked by Bloomberg to make losses.

Electricity output has plunged to about a 30th of that of South Africa, sub-Saharan Africa’s second biggest economy, as attacks on pipelines cut supplies of natural gas to power plants. Mark Bohlund, an Africa economist with Bloomberg Intelligence in London, in the report, said Nigeria’s economy contracted in the first quarter of 2016 by 0.4 percent, the first decline since 2004, adding that if President Buhari doesn’t alter his stance on the naira and loosen the restrictions used to defend its peg to the dollar, output will probably sink further.

“The Nigerian economy is at high risk of experiencing its first full-year recession since 1987,” Bohlund said. An improvement next year depends on security being restored in the oil-rich Niger River delta region and “a shift toward more market based economic policy,” he added. “There’s a sense of exasperation among investors,” Ronak Gopaldas, a Johannesburg-based analyst at Rand Merchant Bank, told Bloomberg, adding “There’s still a level of goodwill toward Buhari and his government, but it’s dissipating. The man on the street is really struggling.”