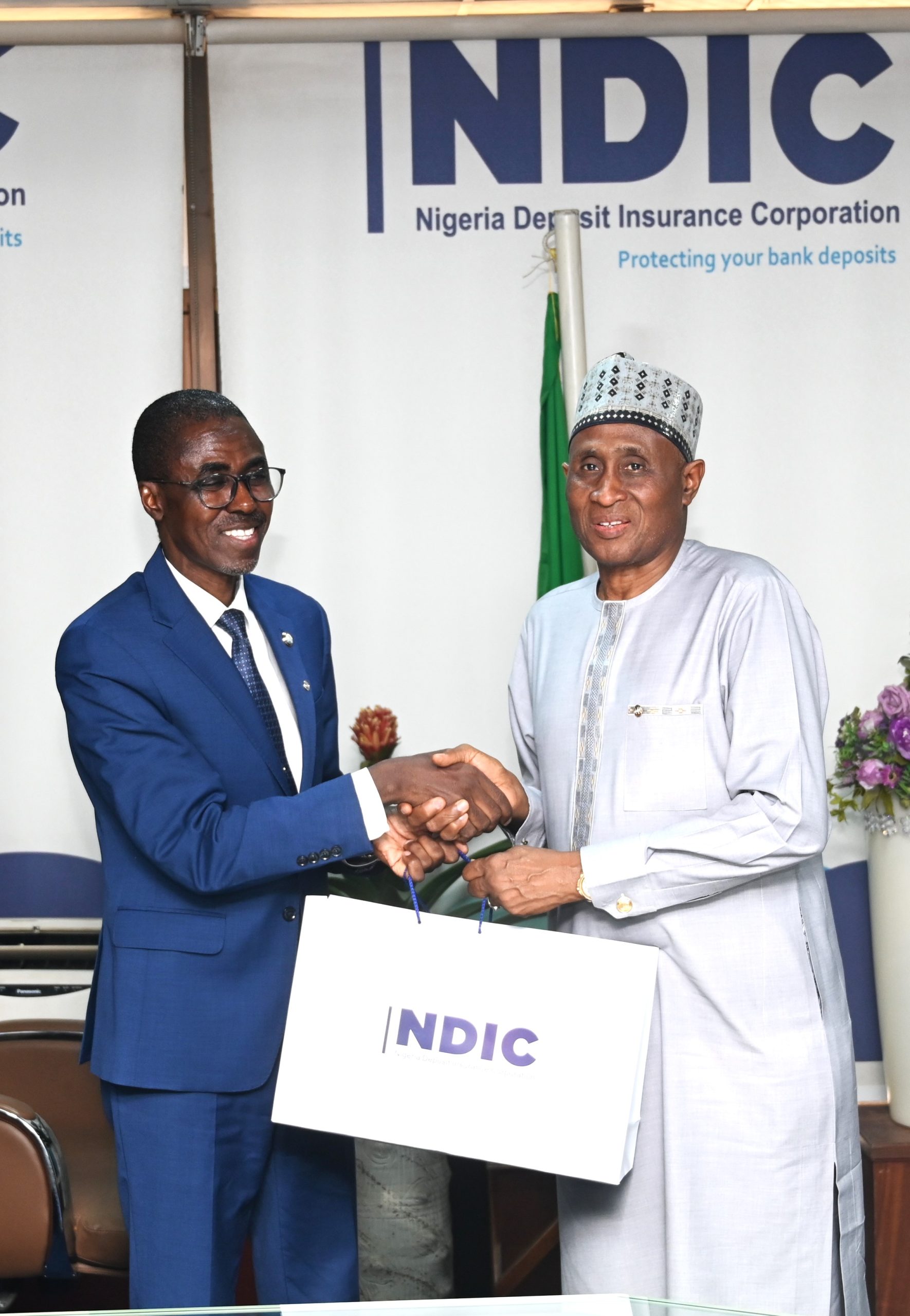

FRC Commends NDIC for Prompt Remittance of Operating Surplus

The Fiscal Responsibility Commission, FRC, has commended the Nigeria Deposit Insurance Corporation, NDIC, for what it described as Prompt and consistent remittance of its operating surplus to the Consolidated Revenue Fund, CRF, in line with provisions of the Fiscal Responsibility Act, FRA Act, 2007. Executive Chairman of the Commission, Victor Muruako made this commendation on […]