Restructuring BOA: Bank to kick off with N250b capital base – Minister

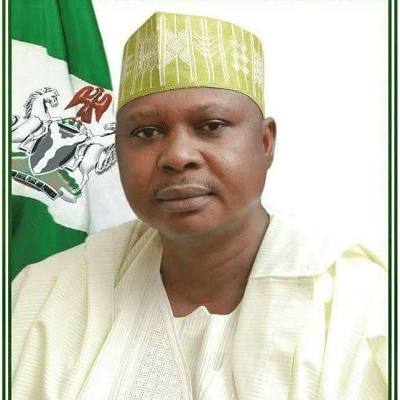

The Minister of Agriculture and Rural Development, Chief Audu Ogbe has revealed that the Bank of Agriculture will raise a kick off capital base of N250 billion to enable farmers access credit at the lower than 6 percent.

Ogbe made this revelation in his office on Tuesday during the meeting of Restructuring and Recapitalization of the Bank of Agriculture in Abuja attended by the Director General of Bureau for Public Enterprises (BPE), Mr. Alex Okoh, Managing Director BOA, Alhaji Kabir Mohammed Adamu.

He said that following the approval of the national council on privatization on Friday 12th April, the kick off meeting which is to formally execute the agreement and also introduce the appointment of the transaction advisers Lead Way Consortium to key stakeholders, FMARD, Ministry of Finance, BOA and the Central Bank of Nigeria (CBN).

Ogbe said: “If this structure we want to put in place now starts working successfully, and we raise a capital base of anything between N200 billion to N250 billion and farmers can access credit at the lower end of the single digit, lower than 6 per cent and 5 per cent, we hope to achieve a whole lot of things”.

Chief Audu Ogbeh expressed optimism that the bank after recapitalization would be a large Bank that will ensure farmers access to loan easily.

He said: “We have a new vision for agriculture, we want to create the farmers bank and we want you to pass the good news to farmers, that this is their chance as co-members and owners of the bank. It has a chance to becoming a large Bank in the future, just like the BOA in China.

Failures in agriculture have been caused by a number of factors, sometimes the excessive interest rate and agronomic practices which are not in place or properly aligned”.

Chief Ogbeh further said; “The Ministry of Agriculture will make sure that they give support to the Bank, so failures are minimized, we begin with the seed, increasing our seed supply to farmers and make sure they don’t fail, we then go on to soil testing, to make sure that the right kind of soil and the kind of fertilizer applied.

While harping on the need to make agriculture the mainstay of the economy, the Minister said that currently Nigeria has saved about $21 billion from food import in the last 3 and half years and exportation has also gone up to 500 per cent.

“Two banks in Nigeria announced that we have actually save $21 billion on food import in 3 and half years, and the Bureau of Statistics has affirmed that agriculture exportation has gone up to 500 per cent since we came in, and we are just beginning.

“We need value addition, we need cottage industries, we need to decongest the cities so that young people can be comfortable in their rural environments, making money and living a good life, we want to minimize the tendency of our young people crossing the desert to Europe in search of happiness which doesn’t exist anywhere”, Ogbeh said.

In his earlier reactions, the Director General of BPE, Mr. Alex Okoh said: “It’s imperative to restructure the bank to substantially improve its operating framework, and governing framework to improve its efficiency