FG planning to cut down taxes, says Finance minister

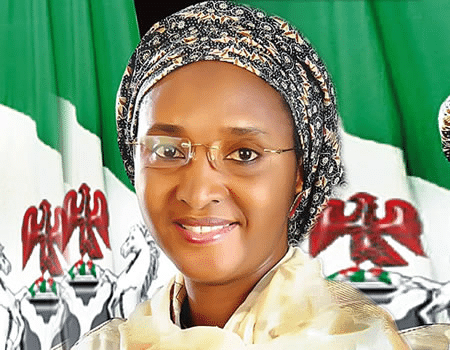

The Minister of Finance , Mrs. Zainab Ahmed, has announced Federal Government’s plan to cut down taxes for poor citizens as well as operators in Micro, Small and Medium Enterprises in the country.

The Finance Minister, who made the announcement on Monday, during a world press conference of activities of the Federal Ministry of Finance and her agencies, said the action to cut down on taxes of the poor and the MSMES was to alleviate their pains and encourage operators in the sector.

A statement by Mr. Paul Ella Abechi, Special Adviser on Media and Communications to the Minister of Finance, explained that the announcement would end speculation and confusion thrown up by the misinformation in certain quarters that the Government was planning to raise taxes next year.

He recalled that the Finance Minister had last week promised to raise taxes collection through ensuring that all high network individuals who at the moment not paying their taxes are captured in the enlarged tax net.

The clarification came as she also declared that henceforth, all heads of revenue generating agencies in the country are to be held culpable for revenue under- performance as part of strategies to combat failing revenue target.

On the tax reform plan, the Minister said:” We are not in any way increasing our tax rate, but collection. If anything, we are reducing taxes paid by the Micro, Small and Medium Enterprises (MSMEs) as a way of encouraging the growth of businesses.

“What the new reform seeks to achieve is targeting high network individuals who do not pay taxes. We are also going to implement the luxury item taxes which approval has since been received but for which implementation is yet to begin,” she added.

As a prelude to the action next year, the Minister recalled that she had recently constituted 8 Tax Appeal Tribunals (‘TATs’) across the nation to accelerate the resolution of over 209 pending cases relating to tax revenues of about US$18.804 billion, N205.654 billion and €0.821 million.

This is critical to ensure that tax payers get a fair hearing and expedite resolution of tax disputes.

Furthermore, she explained that through the tax dispute resolution mechanism, to reduce incidences of tax evasion and improve payers’ confidence whilst ensuring fairness and transparency of tax.

Ahmed gave more insight into the new tax reform plan, saying, “To take advantage of innovative technologies, we plan to leverage data, technological tools & platforms to foster collaboration, grow the revenue base and improve collections.

Given the span of stakeholders that form our port community and for the sake of improving ease of doing business, we plan to deploy a national single window/trade platform that we expect to enhance customs collections to about 90% over a few years.

“We will also improve collaboration between our revenue collection agencies including the Nigerian Customs Services (NCS), Federal Inland Revenue Service (FIRS) and other trade partners to share information and intelligence that will help improve revenue and make collections more efficient.

By automating many of our revenue collection processes such as the deployment of healthpay in the health sector, edupay in education and e-Collections by our Revenue Authorities, we have seen revenue shore up to record high levels.

More specifically, FIRS deployed the e-Services platform that has automated the end to end tax process from registration to collection of Tax Clearance Certificate (TCC).

“The tax initiatives spearheaded by FIRS also include the automation VAT collection at source in some key sectors.

Under my tenure as the Finance Minister, I intend to continue championing such digitalization transformation initiatives that have proven to be a good way forward for our revenue generation drive.

To improve accountability and ultimately improve the performance of Government Owned Enterprises (GOEs) the expenditure plans of these entities are being reviewed.

This initiative will be backed by a more proactive revenue tracking and monitoring mechanism.

“The Committee has been working judiciously to reconcile revenue data as far back as 1999 and will be reviewing our revenue performance on a monthly basis.

This data will be useful in tracking the historical trends and in setting stretch targets to drive the performance of key revenue generating entities.

Finally, we will continue to invest in the capacity building of the financial system (in terms of tools, people & skills) so that we can optimally manage the finances of this country from both the revenue and expenditure perspectives,” submitted.

Reviewing the Federal Government’s expenditure performance in the year 2018, the Minister said despite the revenue shortfall Government was able to pay salaries and service debts 100%.

Furthermore, she said: “We have released seven months overhead funding, and N995bn Capital releases by 21st December 2018. We plan to perform better during the rest of the budget year by driving up revenue generation to improve the fiscal space for spending.

“In 2018, despite the revenue shortfall we have been able to pay inherited debts & liabilities which this administration received in 2015, These debt & liabilities include:.

Paris club over deductions: $5.4 billion; Joint Venture (JV) Cash Call: $6.8 billion; Contractor/Export Expansion Grant (EEG): N1.9 trillion; Refund to States for roads: N488 billion.

As part of President Muhammadu Buhari-led administration’s efforts to ensure all pensioners get their entitlements, the Ministry of Finance, recently made the following payments among others:

Through the Pension Commission (Pencom), we have paid the sum of N54 billion to settle outstanding pension arrears from 2014, 2015 and 2016, as well as paying pensions claims up to March 2017;

Based on verification outcome by the Presidential Initiative on Continuous Audit (PICA), we have also paid over 2,000 former workers of our defunct national carrier- Nigeria Airways Limited;

We are making monthly payments of 9,215 former workers of NITEL/Mtel after over 12 years via Pension Transitional Arrangement Directorate (PTAD).

Also, paid over N571m as gratuity and arrears to 174 Biafra War Affected Retired Police Officers (WARPRO) in October 2017.

Mathew Dadiya