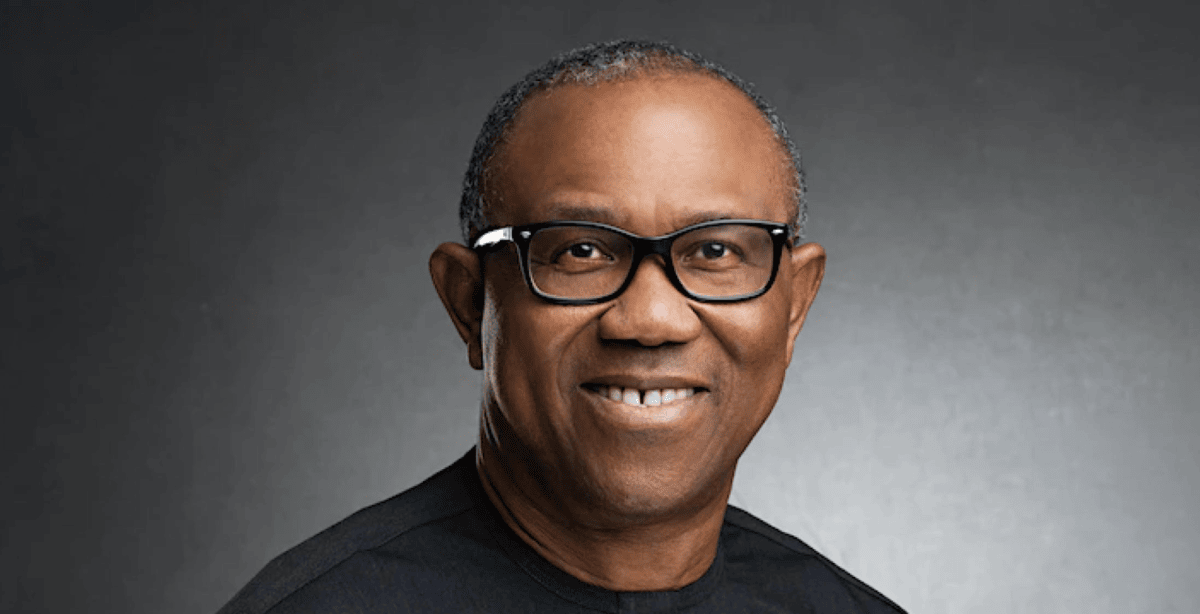

“Driving fintech innovation through strategic partnerships: Insights from Okwuchukwu Udeh, growth leader at sparkle”

Okwuchukwu Udeh is a renowned leader within Nigeria’s fintech sector and has been instrumental in driving transformative initiatives at Sparkle, a pioneering digital bank startup in the country.

With a deep-rooted passion for leveraging technology to advance financial inclusion and drive innovation, Okwuchukwu has adeptly navigated the industry’s complexities, forging impactful partnerships and driving collaborative efforts to address systemic challenges and promote growth.

As the Growth Leader at Sparkle, Okwuchukwu’s visionary leadership and strategic insights have been crucial in establishing the company as an emerging trailblazer in the Nigerian fintech landscape, working towards a mission to revolutionise how individuals and businesses access financial services.

In this interview, Okwuchukwu highlights the vital role partnerships play in driving fintech innovation in Nigeria, sharing insights from Sparkle’s collaborations with industry leaders. She emphasises the importance of ecosystem collaboration and offers advice for fintech entrepreneurs and growth marketers.

Let’s begin by exploring the role of partnerships in driving fintech innovation. Okwuchukwu, could you elaborate on why partnerships are essential for fintech startups in Nigeria, particularly in fostering innovation and growth?

Absolutely. Partnerships are the cornerstone of fintech innovation, especially in a rapidly changing market like Nigeria. Fintech startups often need help with various challenges, such as limited resources, regulatory hurdles, and technological constraints.

By forming strategic partnerships with established players, they can utilise existing infrastructure, expertise, and networks to accelerate their growth and drive innovation.

These collaborations allow the startups to obtain essential resources, address gaps in their offerings, and ultimately provide superior products and services to their customers.

Okwuchukwu, as a leader in the fintech sector, you’ve undoubtedly witnessed the impact of strategic partnerships on growth. For growth marketers looking to incorporate partnership and collaboration into their strategies, could you share some insights on establishing strategic alliances effectively?

Absolutely. Establishing strategic partnerships involves a well-planned approach that includes research and relationship-building. First and foremost, it is crucial to identify potential partners whose expertise, resources, and customer base align with your growth objectives.

To ensure you make the right choice, conduct thorough due diligence and assess compatibility in values, goals, and market positioning.

Additionally, leveraging existing networks, attending industry events, and engaging with relevant stakeholders can help identify potential partnership opportunities.

Once you’ve identified potential partners, initiating conversations and building relationships through open communication, collaboration, and mutual value proposition are vital in laying the foundation for successful partnerships.

Could you share some best practices for growth marketers when teaming up with the right partners to drive growth and innovation in the fintech sector?

When partnering with other businesses, it is essential to establish clear objectives, expectations, and key performance indicators to measure the partnership’s success. Working closely with partners to co-create value-added offerings, such as joint marketing campaigns, product integrations, or bundled services, can help drive customer acquisition, retention, and revenue growth.

It’s also important to maintain open lines of communication, regular performance reviews, and feedback loops to nurture long-term relationships and ensure alignment between both parties. Finally, it’s critical to remain agile and adaptable to evolving market dynamics and leverage data-driven insights to optimise partnership strategies and stay ahead in the competitive fintech landscape.

Could you share some specific examples of how partnerships have driven innovation and growth at Sparkle as a startup?

I’d say that our collaboration with Network International has been a key partnership in our growth journey. As the leading enabler of digital commerce across Africa and the Middle East, Network International provided the backbone for our payment card offering, ensuring seamless and secure transactions for our users.

This partnership improved our product offering and accelerated our market penetration and customer acquisition efforts by leveraging Network International’s expertise and infrastructure.

Our partnership with Visa is another example of how collaborations have fuelled innovation and growth at Sparkle. Visa’s mission to benefit consumers, entrepreneurs, and SMEs across Nigeria perfectly aligns with our goals. Therefore, through this partnership, Sparkle was able to offer Visa cards to our users, giving them access to a vast network of merchants and ATMs, which enhanced their payment experience and expanded their financial accessibility.

Furthermore, Visa’s support extended beyond the product level. The company provided Sparkle with over $40,000 to support our growth marketing efforts, enabling us to reach more customers and drive further expansion.

This injection of funds has allowed us to increase our marketing efforts, expand our audience, and strengthen our position as an emerging fintech company in Nigeria.

Regarding alignment between partners, how do you ensure that partnerships remain aligned with Sparkle’s overall growth strategy and objectives?

Sparkle, we believe that aligning and collaborating with our partners is crucial for success. We start by setting clear goals, expectations, and success metrics to ensure that both parties work towards a common objective.

We maintain regular communication, performance reviews, and feedback sessions, which help us monitor progress, identify improvement areas and make necessary adjustments. Maintaining a shared vision and commitment to delivering value to our customers is at the core of our partnership philosophy, ensuring that our collaborations remain aligned with our overall growth strategy and objectives.

Moving forward, how do you envision leveraging partnerships and fostering ecosystem collaboration among fintech stakeholders to address industry challenges and promote innovation in Nigeria?

Collaboration within the fintech ecosystem is paramount for driving systemic change and addressing industry challenges. At Sparkle, we understand the significance of engaging with industry experts, regulatory bodies, and fellow fintech startups to foster a culture of collaboration and knowledge sharing.

Our partnerships with Microsoft and PricewaterhouseCoopers (PwC) Nigeria exemplify this approach, as they have enabled us to access cutting-edge technologies and industry-leading expertise in areas such as cloud computing, data science, and financial advisory services.

Furthermore, cross-sector partnerships between fintech startups, banks, telecommunications companies, and other industries can unlock new opportunities and drive synergies that benefit all stakeholders.

In the same way, initiatives such as innovation hubs, accelerator programs, and industry events play a crucial role in bringing together stakeholders from across the ecosystem to collaborate on common goals and initiatives.

I believe fintech stakeholders in Nigeria can collectively drive innovation, promote financial inclusion, and ultimately contribute to economic growth and development by fostering a collaborative environment and actively seeking partnerships.

For growth marketers looking to leverage partnerships for growth, what key considerations should they consider when evaluating potential partners?

Growth marketers should consider shared values, complementing strengths and capabilities, market reach, and scalability when assessing potential partners.

Determining if the partnership can help them reach new markets, customer segments, or distribution channels that align with their growth goals is crucial.

Moreover, evaluating potential partners’ reputations, track records, and financial stability can reduce risks and ensure a mutually beneficial collaboration. Eventually, choosing partners with a similar vision, commitment to innovation, and customer-centric approach can enhance the impact of partnerships on growth and success.

As a growth leader in the Nigerian fintech sector, how do you navigate the challenges of forming and maintaining strategic partnerships?

Navigating partnerships within the fintech sector can be challenging due to cultural differences, regulatory complexities, and varying business objectives.

However, businesses can overcome these challenges by prioritising clear communication, mutual trust, and aligning goals and values.

READ ALSO: Minister charges Nigerians on online skills.

At Sparkle, we strongly emphasise building long-term relationships with our partners based on transparency, integrity, and mutual respect.

Additionally, regular communication and collaboration are essential to ensure that both parties remain aligned and focused on achieving shared objectives.

As we conclude, what advice would you give to aspiring fintech entrepreneurs looking to leverage partnerships for growth and innovation in Nigeria?

I recommend prioritising partnerships as a strategic imperative for those aspiring to become fintech entrepreneurs.

Creating a solid network of partners and collaborators can provide startups access to critical resources, expertise, and market opportunities that would otherwise be difficult to attain independently.

However, it’s crucial to approach partnerships with a mindset of mutual benefit and shared value, prioritising trust, transparency, and alignment of goals. By leveraging the power of partnerships, startups can accelerate their growth, drive innovation, and impact Nigeria’s dynamic fintech landscape.

Thank you, Okwuchukwu, for your valuable insights and expertise on partnerships and collaboration in the fintech sector.

Thank you for having me.