Bank’s Exposure to Etisalat $1.2 billion Loan given-Report

Following the failed negotiations on debt management and debt restructuring between Etisalat and Nigerian Banks, Exotix Partners, a UK based Specialist Investment Bank, has released a report outlining the impact of the $1.2billion loan on the affected banks.

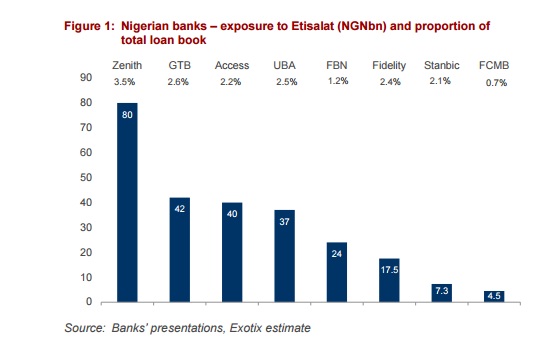

The report revealed that Zenith Bank which carries a total of US$262 million (N80 billion) of the Syndicated US$1.2 billion Etisalat Loan, has the highest exposure of 3.5 percent in relation to its loan book.

The report further showed Guaranty Trust Bank (GTB) comes next with an exposure or 2.6 percent, through the loan of US$137 million or N42 billion against the bank’s total loans of N1.6 trillion for the 2016 financial year.

Next on the list was Access Bank’s US$131million or N40 billion to Etisalat representing 2.2 percent of its total N1.8 trillion loans in 2016.

UBA’s loan of N37 billion represented 2.5 percent of its loan book, FBN Holdings’ N24 billion amounted to 1.2 percent of the bank’s loan book, Fidelity’s N17.5 billion resulted in a 2.4 percent exposure, Stanbic’s N7.3 billion stood at 2.1 percent exposure and FCMB’s N4.5 billion represented 0.7 percent of its FY 2016 loan book.

The report, however, identified the impact of the Etisalat Loans as manageable, noting that the loan has a modest impact on the affected banks.

A sensitivity analysis carried out in the report, projects that the loan’s impact on Zenith Bank’s 2017f profit, Equity and Capital Adequacy ratio may be -19%, -3% and -0.5% respectively.

For GTB the impact is projected at -7%, -2% and -0.3% on 2017f profit, Equity and Capital Adequacy ratio respectively, while the impact of the loans on Access Bank’s 2017f profit, Equity and Capital Adequacy ratio is pegged at -15%, -2% and -0.3% respectively.

The investment bankers pegged the impact on profit, Equity and Capital Adequacy ratio, for UBA at -14%, -2% and -0.4% respectively; for FBN Holdings at -15%, -1% and -0.2% respectively; For Fidelity at -43%, -2% and -0.4% respectively; For Stanbic at -4%, -1% and -0.2% respectively; and for FCMB at -8%, -1% and -0.1% respectively, adding that FCMB and Fidelity profit sensitivities based on FY 16 profits given loss making or low income in 2017f.

“At a headline level, loans to Etisalat Nigeria represent 1.9 percent of aggregate bank loans. Likewise on our sensitivity analysis the Etisalat loans would on average have a -12%, -2% and -0.3 bp impact on our FY17f net profit, equity and capital adequacy ratios for the banks, respectively.”

“We believe the banks should easily be able to absorb a shock of this magnitude. However, if this development is a precursor to more general difficulties in FCY loan exposure, which represents on average 47% of the total loan book, then we may see a more pronounced deterioration in the equity base of banks.

“Within our coverage Diamond Bank is likely to be the most impacted, while Wema should be least impacted” the investment bank stated

Etisalat Secured the $1.2 billion loan in 2013 from 13 Nigerian banks namely Zenith Bank, Guaranty Trust Bank, Access Bank, United Bank for Africa, First Bank, Fidelity Bank, Stanbic IBTC, FCMB, Union Bank of Nigeria, Ecobank, Keystone Bank, FSDH and Mainstreet Bank to refinance existing obligations (estimated at US$650 million, representing 54.17% of total facility) and most parts of the remaining fund was used to finance network expansion, with the intention to pay back within 7 years.

Although Etisalat’s earnings have been under significant pressure in the past few years, Analyst at Cordros Securities noted in a report on the Banking Sector that discussions with the banks revealed that Etisalat had consistently serviced the loan obligation since inception.

“However, following the evident drag in the macro environment in 2016 – significant currency depreciation (which drove sizable jump in FX revaluation losses on its FCY Liabilities), weakened consumer spending, coupled with the impact of the competitive pricing environment on subscribers growth, Etisalat’s cash flow was significantly pressured.

Revenue was flat in 2016, while a further impact of FX blotted related costs (roaming cost, rental charges, and network costs) drove a double-digit decline in EBITDA (down 20.86%) to N33 billion.”