TSA: 18 months after

Against the backdrop of the need to ensure accountability in the handling of government revenue, enhance transparency and check misapplication of public funds, the Buhari administration introduced the policy of Treasury Single Account (TSA) into public accounting system at the federal level about 18 months ago.

Under the system, all government revenues, receipts and income are collected into one single account, usually maintained by the Central Bank of Nigeria while all payments are done through the same account.

In the main, TSA enables proper monitoring of government receipts, expenditure and helps to block most leakages in government. Such leakages have over the years largely contributed to the slow growth of the economy.

With the introduction of TSA came a better cash management of government funds, elimination of idle funds usually left with different commercial banks and enhanced reconciliation of revenue collection and payment.

In particular, since the accounts of Ministries, Departments and Agencies (MDAs) of government with the money deposit banks are zeroed every day, the banks no longer have access to the float provided by the accounts they maintained for the MDAs.

The introduction of TSA in 2015 has been a source of pain to money deposit banks. This is because prior to the introduction of TSA, public sector funds constituted a large chunk of commercial banks’ deposits. Indeed, when TSA was introduced, the commercial banks held more than N2.2 trillion of public sector funds.

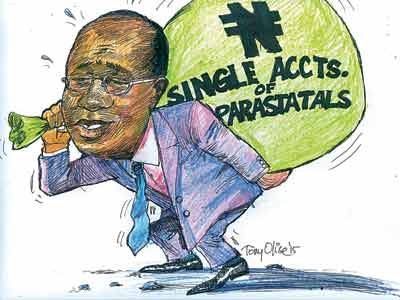

The impact of such a huge amount of money leaving the banking system was debilitating and excruciating to the banks and to the country’s economy. Far more disturbing to the banks was the movement of funds of revenue generating parastatals such as the Nigerian National Petroleum Corporation (NNPC), out of commercial banks.

For the banks, implementation of the TSA policy brought some unintended consequences, such as deposit depletion, resulting in low asset quality, decreased revenue and liquidity stress, thus affecting the operation of all the banks and visiting economic hardship on Nigerians at a time the country was going through an agonising recession. In the absence of cheap public sector accounts, the banks were forced to reposition their strategies to survive in the light of the new realities forced on them by the government.

In the main, the banks responded by concentrating more on their traditional roles of savings aggregation and financial intermediation. To improve their performance the banks also became more innovative in generating revenue to support their operations and improve their profitability.

Some of them increased interest rates on deposits to attract more customers, while some increased the interest rates on their loans to shore up their profitability. It is admitted that government is the largest spender in the economy.

At the commencement of the execution of TSA more than N2.2 trillion of the federal government MDAs’ funds were pulled out of the deposit money banks with debilitating impact on banks’ liquidity and hampering their ability to successfully carry out their financial intermediation in the economy and visiting harshness on the citizenry. Banks perform very important roles in the economy. The failure of any major bank may bring incalculable and undesirable effects on the economy.

Consequently, in executing any new policy, government should always carefully consider its consequences on the economy. Going forward and in the light of the untold hardships on Nigerians as a result of the harsh realities of the economy in the recent past, we believe that government being the largest spender in the economy should not be totally shut out of the banking system as the operations of TSA have shown so far. Consequently, TSA should be fine tuned to enable it work in those banks where government Ministries, Departments and Agencies (MDAs) have accounts to pool together MDAs’ balances every day. The banks should also be made to pay interest on all credit balances and charge interest on all debit balances in the accounts of the MDAs.