Euro slips as stocks drop in muted holiday trading

Thin trading was the biggest feature of global markets on Tuesday, with stocks in emerging nations turning lower and most major currencies lacking direction as many countries remained on holiday. The euro declined, gold rose, and U.S. Treasuries edged downward.

Equities were shut across the large European markets, as well as in parts of Asia including Hong Kong and Australia.

Japanese benchmarks dropped from the highest levels since the early 1990s, helping to pull the MSCI Asia Pacific Index down, while shares in Dubai, Qatar and Russia were among the big losers in emerging markets. S&P 500 futures were flat as those for the Dow Jones slipped.

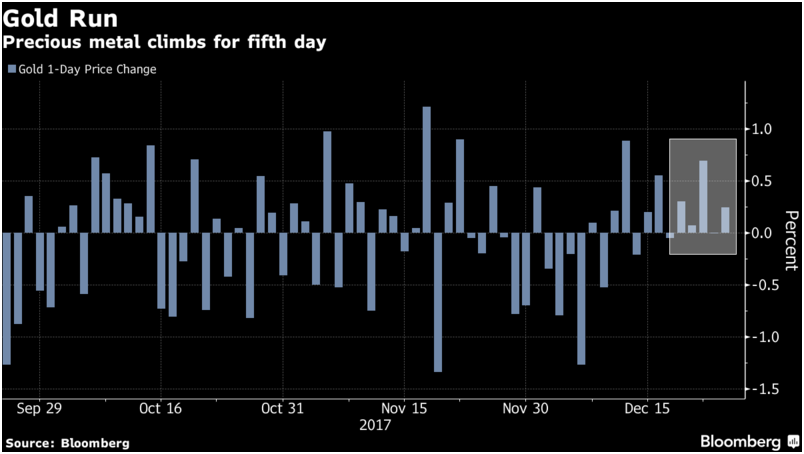

The pound weakened alongside the euro, while the Russian ruble, South African rand and South Korean won were among gainers in the currency market. Gold extended its recent advance as silver also jumped.

Traders are finding little to get excited about as the stellar year for risk assets crawls to its end, with the possible exception of the cryptocurrency roller coaster.

They may be opting to enjoy the relative calm — tensions are simmering between the U.S. and Russia, Italy’s parliament is set to be dissolved for a risky European election, and big decisions on the American debt ceiling were merely kicked down the road. That’s all set up a potentially eventful 2018.

Elsewhere on Tuesday, West Texas oil held above $58 a barrel as trading resumedfollowing the Christmas holiday and after U.S. explorers refrained from adding rigs for a second week. Bitcoin rallied as the biggest cryptocurrency attempted to shrug off a miserable five-day run.

Ganiyu Obaaro, with Agency Report