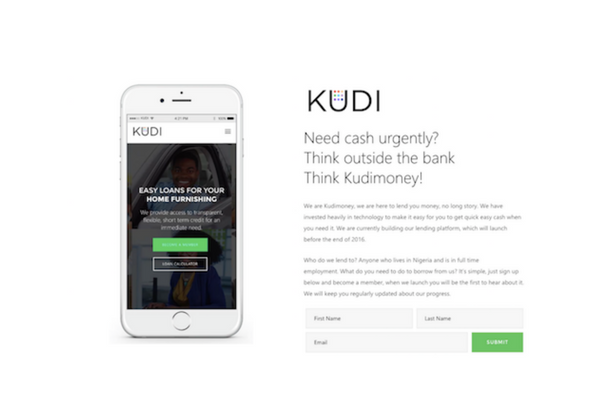

Kudi Capital unveils online lending portal in Nigeria

Kudi Capital Management Ltd has declared the public launch of Kudimoney.com a fully licensed online lending platform offering unsecured personal loans to consumers in Nigeria.

At kudimoney.com, creditworthy borrowers can apply for fixed-rate, no-fee personal loans of up to N1, 000,000 over a six month period.

Applicants are assessed and receive an immediate credit decision, followed by automated verification steps for final approval.

Kudimoney provides an online lending platform dedicated to creating innovative and practical financial products providing Nigerian residents with access to easy, secure, transparent, and flexible loans.

The company founded in late 2016 by Babs Ogundeyi was launched to remedy the challenges of access to short term credit and is positioned to quickly establish itself as a platform of choice for consumer lending in Nigeria with over 5,000 registered Kudimoney customers in Nigeria.

Ogundeyi said “At Kudimoney we are offering an option for consumers who are searching for a simple hassle-free loan alternative for everyday needs.

“Technology offers boundless opportunities to make everyday living better. Finance is integral to daily living and Kudimoney offers both. Consumers are central to the design of the Kudimoney loan product.

“There are no lengthy loan approval processes as Kudimoney membership can be completed online, allowing customers to apply for a loan 247 as long as they are Nigerian residents. There are no hidden fees, no early repayment penalties and limited payment options.

“Kudimoney is transparent and customers can choose their monthly payment date and a payment option designed to fit their budget”.

With Kudimoney, customers can apply for loans on the website, http://www.kudimoney.com, within hours, in 4 easy steps including registering at www.kudimoney.com, calculating your loan repayment plan with our easy to use Kudimoney calculator, filling out your application and receiving and accepting offer after verification.

Over the next few months, Kudimoney.com will be rolling out various innovative loan products targeted at both individuals and SMEs.

The company has also applied for a banking license from Central Bank of Nigeria to officially become an online bank offering revolutionary current and savings accounts to all Kudimoney customers.