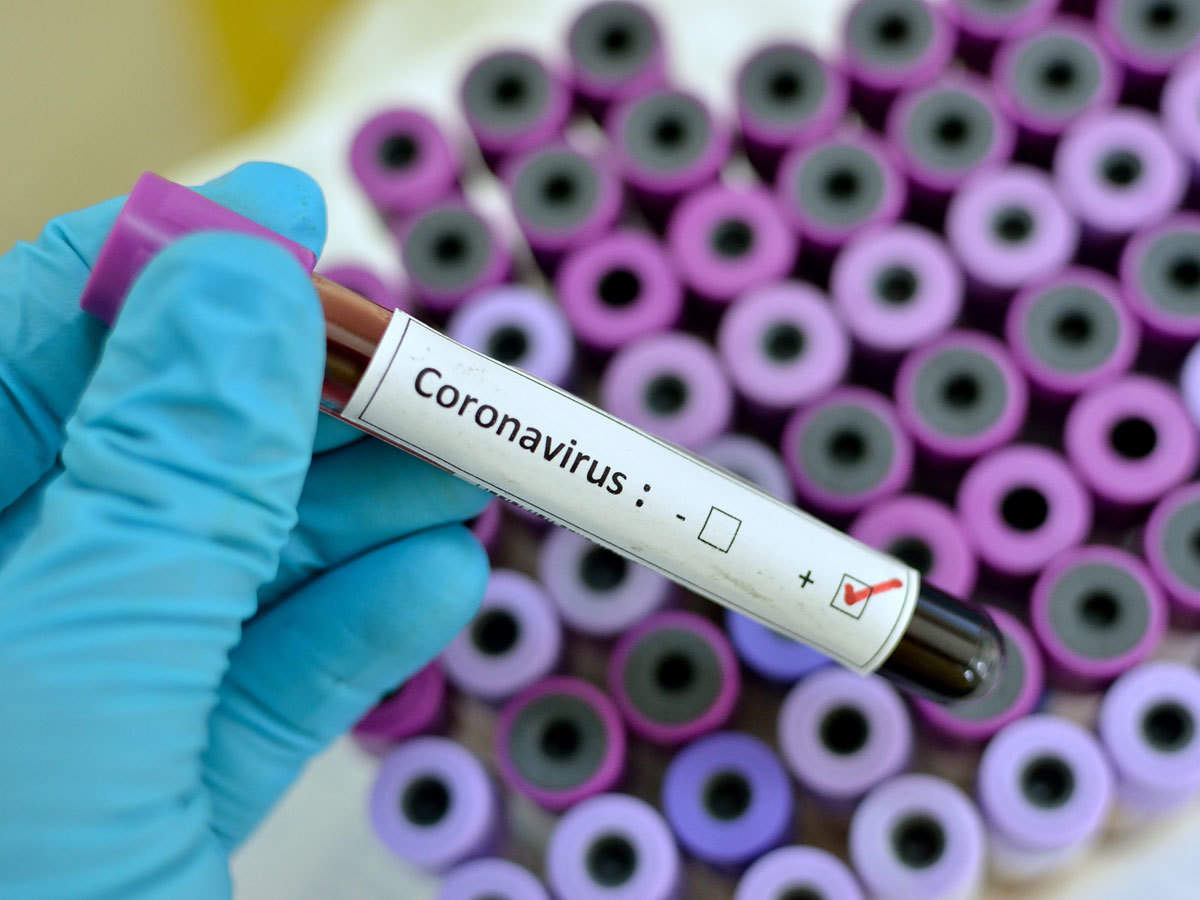

Coronavirus: Real sector, capital market to lose N10trn

…As confirmed cases rise to 111 in 11 states and Abuja

…Dangote, Ovia, Rabiu, others donate billions to FG

…Renown economist, Prof. Obadan raises alarm on micro-economic impact

The Coronavirus (COVID-19) pandemic is fast having a ripple effect on Nigeria, crippling virtually all sectors of the economy, leading experts to predict that the Oil and gas, capital market, other sectors may lose about N10 trillion.

This is even as the Nigeria Centre for Disease Control (NCDC), on Sunday, confirmed that fourteen new cases of COVID-19 have been reported in Nigeria with 9 in Lagos and 5 in FCT.

It said “as at 09:30 pm 29th March, there are 111 confirmed cases of #COVID19 reported in Nigeria with 1 death,” adding that three victims had been discharged earlier.

The worst hit sectors since the outbreak of the virus is the oil and gas sector, capital market as well as the aviation sector.

The oil price market has been badly hit by the pandemic as international crude oil price now fluctuates $23 to $25 per barrel, forcing the Federal Government to review crude oil prices as approved in the 2020 budget.

Only recently, the Atlantic council predicted that the effect of the Covid-29 on Nigeria’s economy will amount to about N5.6 trillion.

Also, the Economic Commission for Africa (ECA) on Friday warned that the unfolding coronavirus crisis could seriously dent Africa’s already stagnant growth with oil exporting nations losing up to US$ $65 billion in revenues as crude oil prices continue to tumble.

Speaking at a press conference in Addis Ababa, ECA Executive Secretary, Vera Songwe, said having already strongly hit Africa’s major trading partner, China, COVID-19 was inevitably impacting Africa’s trade.

She said although a few COVID-19 cases have been reported in some 15 countries far, the crisis was set to deal African economies a severe blow.

“Africa may lose half of its GDP with growth falling from 3.2% to about 2 % due to a number of reasons which include the disruption of global supply chains,”

Analysts have forecast that oil prices won’t trade beyond $30 per barrel for the rest of the year, causing panic among oil producing countries who have all budgeted oil prices above a benchmark of $50 per barrel.

Another sector feeling the heat of the pandemic is the aviation sector.

The International Air Transport Association (IATA) at the weekend warned that Nigeria is at risk of losing 2.2 million overseas-bound passengers and N160 billion revenue loss, if the coronavirus spread continues to escalate.

The association that represents some 290 airlines said the gloomy outlook was not peculiar to Nigeria, but spreads across the region and warrant emergency support for the airlines.

READ ALSO: Set up a Coronavirus economic relief fund now, expert tells FG

“The disruption to air travel due to the continued spread of coronavirus will cost Nigeria’s aviation industry over N160.58bn (using Bureau de Change rate of N370 to $1) ($434m) in revenue and 22,200 jobs,” the International Air Transport Association said.

IATA said if the pandemic lasts for a three-month period, there will be a 38% fall in global demand and a $252 billion loss of passenger revenue.

IATA also said that the country would also lose approximately 2.2 million passengers.

IATA said: “International bookings in Africa are down roughly 20 per cent in March and April, domestic bookings have fallen by about 15 per cent in March and 25 per cent in April, according to the latest data.

“African airlines had lost $4.4bn in revenue as of March 11, 2020. Ticket refunds have increased by 75 per cent in 2020 compared to the same period in 2019 (01 February – 11 March).”

Director-General and Chief Executive Officer, IATA, Alexander de Junaic, appealed for governments’ support for the industry.

He said: “Stopping the spread of COVID-19 is the top priority of governments. But they must be aware that the public health emergency has now become a catastrophe for economies and for aviation.

“The scale of the current industry crisis is much worse and far more widespread than 9/11, SARS or the 2008 Global Financial Crisis,”

Experts further say that letting this industry fail will have an impact far beyond the livelihoods of the 2.7 million people airlines employ. And it will go beyond the 65 million other jobs in the value chain.

As it is, all Nigerian domestic carriers namely Max air, Azman air, Arik air and Aero contractors, Air peace and Medview have shut down flights completely except for emergency flights involved in the fight against the Covid 19.

The manufacturing sector is not also left out of the Covid-19 scourge as it has taken a direct impact on production, supply chain and market disruptions.

Many manufacturing firms rely on imported intermediate inputs from China and other countries affected by the disease.

Many companies especially pharmaceuticals also rely on sales in China to meet financial goals.

The slowdown in economic activity and transportation restrictions in affected countries is having a huge impact on the production and profitability of specific global companies, particularly in manufacturing and in raw materials used in manufacturing.

This has become worrying especially on a sector that accounts for 48% of GDP, and a combined contribution of N459bn GDP, as there are fears that businesses will be grounded in a drive to contain the virus.

The stock exchange market is also one of the casualties of the Covid-19 impact as statistics from the Nigerian Stock Exchange shows that already, Stock market investors have lost over N2.3 trillion barely three weeks after the first case of coronavirus, which is currently ravaging the whole world, was confirmed in Nigeria on February 28, 2020.

Investors have already expressed panic and the situation even further led to the postponement of Capital Market Meeting (CMM) by the Securities and Exchange Commission billed to hold in April.

Another sector affected are Sports Betting Companies as sporting events are one of the most common types of events being cancelled or portioned across Asia, Europe and America.

The major leagues such as the English Premier League, Spanish La Liga and the Italian Serie A, just to name a few, have been suspended football till further notice. The American NBA is also a victim.

This suspension will have serious effects on the income of Nigerian sport betting companies which put up matches on their platforms for bettors and punters to stake and win or lose money. It is estimated that these companies gross N100m every weekend from bettors staking on thousands of games.

In Nigeria also, hospitality businesses are grounded. Two biggest 5 star hotels in the country, Transcorp Hilton hotel Abuja and Eko hotel in Lagos have announced partial closure, directing majority of its workers to stay at home.

Already businesses have closed completely in the country except for pharmaceuticals and traders selling food items.

Currently, Nigeria SMEs contribute 48 per cent of the country’s GDP with a total number of about 17.4 million, according to statistics obtained from the National Bureau of Statistics.

As such, it is estimated that as the lockdown and sit-at-home order by the government at federal and subnational levels persist, about 17 million SMEs will be out of job tentatively, which adds to the unemployment rate of 24 per cent.

The transportation sector is also another sector that is expected to be hit by the impact of the Covid-19. As it stands, most state government have banned inter-state travels which practically entails that commercial taxis will be out of job for the mean time considering when the federal government will declare the country Coronavirus free.

Also, the entertainment sector which contributes about N239bn, according to National Bureau of Statistics to the country’s economy, is also expected to be drastically affected.

On parliatives to cushion the effect of the pandemic on business, the Central Bank of Nigeria announced a N1 trillion intervention stimulus to reflate the economy.

Minister of Finance, Budget and National Planning, Zainab Ahmed, disclosed last Wednesday at a meeting between the leadership of the National Assembly and some Ministers and Heads of agencies from the Executive arm of Government to brainstorm on the impact of Coronavirus pandemic on the Nigerian economy that the CBN had established a facility for households and small- and medium-sized enterprises (SMEs) that have been particularly hard hit by Covid-19

She said this fund among things will enable the Federal Government make provision for health sector interventions by introducing import duty waivers for essential input for pharmaceutical firms; tax waivers on new equipment; and deferment of tax to increase production.

Ahmed further disclosed that the Federal Government would be releasing the total sum of N6.5 billion in two tranches (N1.5 billion and N5 billion) to the National Centre for Disease Control (NCDC) as intervention to assist in the fight against the spread of the COVID-19 disease in Nigeria.

Also, she stated that the Lagos State Government would receive financial support from the Federal Government to the tune of N10 billion to combat Coronavirus spread in the state.

The Finance Minster said that the sum of one billion naira would be released by government to Pharmaceutical firms in the country.

The minister also stated that Nigeria has accessed a $2 million dollar UN humanitarian fund which will be channeled to the welfare of internally displaced persons.

Similarly, President Muhammadu Buhari has approved the request of the Nigeria Centre for Disease Control for an aircraft from the Presidential air fleet for emergency situations.

To complement government’s effort Aliko Dangote, through the Aliko Dangote Foundation (ADF), said he will be leading a coalition of private sector organisations to support the Federal Government’s ongoing efforts to tackle the coronavirus (COVID-19) menace sweeping across the country.

The initiative, which is called the Coalition Against Coronavirus (COCAVID), will involve the erection of fully-equipped medical tents to house patients and serve as training, testing, isolation and treatment centres, with an additional facility also provided in Victoria Island, Lagos.

Already, the UBA group have donated N3bn to Nigerian government to fight Covid 19, while Kano billionaire and CEO of BUA group Abdulsamad Isiyaka and oil magnet Femi Otedola have donated N1bn each. Also NNPC group and its partners, Aliko Dangote, Atiku Abubakar have made a donation of N200m, N50m and N11bn respectively.

Similalry, the bank CEOs of Zenith Bank, UBA, GT Bank, Acesss Bank among others, and Aliko Dangote are expected to mobilise N10bn fund for the fight against coronavirus in collaboration with the Central Bank of Nigeria.

In addition, Gurantee Trust Bank and Access Bank donated 100 bed Intensive Care Unit for patients, God is Good Motors donated buses to Nigeria Centre for Disease Control, while Aero Contractors offered planes to move medical items across the country.

Similarly, the Redeemed Christian Church of God, and Dunamis Gospel centre have also made donations of respirators and ventilators as well as safety kits to government in a bid to fight the virus.

This is in addition to test kits and safety wears donated by Chinese billionaire Jack Ma last week worth billions.

However, an economist and a member of the Monetary Policy Committee of the CBN, Prof. Mike Obadan, said government must look at the micro economic impact of the virus and not only concentrate on the macro economic impact.

“So far, the economic impact of Covid-19 has largely been macro in nature because of the sharp drop in crude oil and government revenues has been affected and foreign exchange reserves have been affected and so the measures taken so far is taken to address the macro economic impact, so the economy can adjust.

“Now that consumption is higher than revenue available because of drop in crude oil price, adjustment is necessary which is why government’s budget is reviewed, crude oil prices are also reviewed downwards and also federal government giving some directives like embargo on appointments and eliminating expenditures both recurrent and capital that are not essentials.

“However, we have a situation where the economy is moving towards a lockdown, what that then means is that most economic activities won’t happen during the lockdown because producers not in the essential areas won’t produce which means there will be scarcity of goods and services, prices will rise, which is why those issues need to be addressed.

“Importantly, there is a large group that will be affected at the micro-economic level. In order words, the micro-economic impact will be much more visible in terms of effects on individuals, households and there is a group of Nigerians on daily pay. We also have traders in that category who sell and eke out a living are likely to be heavily impacted because they won’t have any income to sustain their living,” he said.