President Tinubu Reaffirms Commitment to Ongoing Economic Reforms

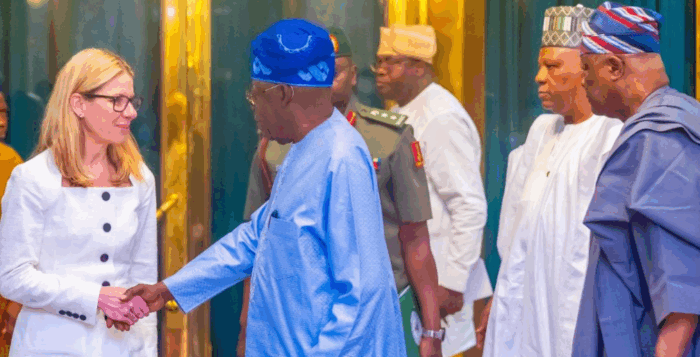

President Bola Ahmed Tinubu has stated that the Nigerian government will maintain its current trajectory of economic reforms, emphasizing that there will be no reversal of the policies initiated since mid-2023. The President made these remarks on February 3, 2026, during a high-level meeting at the State House in Abuja with a delegation from the World Bank, led by the Managing Director of Operations, Anna Bjerde. The meeting served as a formal review of Nigeria’s fiscal and monetary adjustments and their impact on the broader macroeconomic landscape.

The President’s “no turning back” stance centers on two primary policy pillars: the removal of the petrol subsidy and the unification of the foreign exchange market. These measures, while contributing to an initial surge in inflation, were designed to eliminate massive fiscal leakages and bridge the gap between official and parallel market exchange rates. The administration contends that these adjustments are essential precursors to the “Renewed Hope” agenda, which targets an ambitious expansion of the Nigerian economy to $1 trillion by 2030.

World Bank officials characterized Nigeria’s current reform program as a “global reference point” for difficult but necessary economic stabilization. Anna Bjerde noted that the bank is encouraged by the consistency of the policy implementation, which has begun to attract renewed interest from international investors. To support these efforts, the World Bank has remained a key development partner, recently approving various financing packages, including the $2.25 billion Nigeria Reforms for Economic Stabilization to Enable Transformation (RESET) program, which aims to improve non-oil revenue mobilization and protect the most vulnerable households.

The economic context of this commitment is defined by a slow but steady moderation in inflationary pressures. After reaching a multi-decade high in 2024, headline inflation has begun to respond to the Central Bank of Nigeria’s (CBN) aggressive monetary tightening and the introduction of the Electronic Foreign Exchange Matching System (EFEMS). The EFEMS has been credited with enhancing transparency in the foreign exchange market, allowing the naira to find a more stable equilibrium against the U.S. dollar, which in turn reduces the volatility of import costs for Nigerian businesses.

However, the reporting of these successes is balanced by the immediate challenges facing the manufacturing and agricultural sectors. High energy costs and the increased price of imported inputs have strained the productivity of local industries. To mitigate these effects without abandoning the core reforms, the federal government has pivoted toward “capacity-driven inclusion.” This includes the deployment of the Presidential Compressed Natural Gas (CNG) initiative, which aims to reduce transportation costs, and the expansion of the National Social Investment Programme (NSIP) to provide cash transfers to millions of Nigerians affected by the rising cost of living.

Historical context suggests that Nigeria has attempted similar structural adjustments in the past, most notably during the Structural Adjustment Program (SAP) of the 1980s. Unlike previous iterations, the current administration has emphasized that the 2023-2026 reforms are backed by a more robust digital infrastructure for social safety nets, intended to prevent the reform fatigue that stalled earlier economic transitions. The World Bank delegation highlighted that the success of the current phase depends on the government’s ability to ensure that the macroeconomic gains are “transmitted” to the micro-level through job creation and improved infrastructure.

Looking forward, the government is focusing on the “post-stabilization” phase of its plan. This involves leveraging the fiscal space created by subsidy removal to fund large-scale infrastructure projects, such as the Lagos–Calabar Coastal Highway and the expansion of the national power grid. By 2026, the administration expects these investments to stimulate the non-oil sector, particularly in digital economy and agriculture, reducing the nation’s historical over-reliance on crude oil exports for foreign exchange earnings.

The World Bank reaffirmed its commitment to providing technical and financial support as Nigeria navigates the remaining hurdles of its reform agenda. The bank’s upcoming Country Partnership Framework is expected to focus on human capital development, with a specific emphasis on bridging the skills gap in the technology sector to support the growing youth population.