MoMo PSB Expands Cross-Border Transfers, Strengthens Global Remittance Links

MoMo Payment Service Bank (MoMo PSB), the financial subsidiary of MTN Nigeria, has broadened its cross-border transfer service, extending outbound coverage to more African markets, including Kenya and South Sudan, while deepening inbound remittance channels from the United Kingdom, United States, Canada, and Europe.

With this expansion, MoMo PSB customers in Nigeria can now send money to a wider network of African countries such as Ghana, Benin Republic, Rwanda, Togo, Cameroon, DR Congo, Congo Brazzaville, The Gambia, Côte d’Ivoire, Liberia, Malawi, Zambia, Sierra Leone, Uganda, and the newly added Kenya and South Sudan.

On the inbound side, Nigerians can conveniently receive international transfers directly into their MoMo wallets from senders across major Western economies, reinforcing MoMo PSB’s growing role in enabling fast, secure, and inclusive cross-border payments.

The enhanced service underscores MoMo PSB’s commitment to advancing financial inclusion by simplifying the process of moving money across borders. Customers benefit from swift transaction processing, competitive exchange rates, secure transfers, and the ease of receiving funds directly into their MoMo wallets, eliminating many of the delays and frictions traditionally associated with remittances.

The expansion is powered by strategic partnerships with Brij, Lightway Finance, and Thunes, leveraging their global payments infrastructure to deliver reliable, efficient, and compliant transfer experiences.

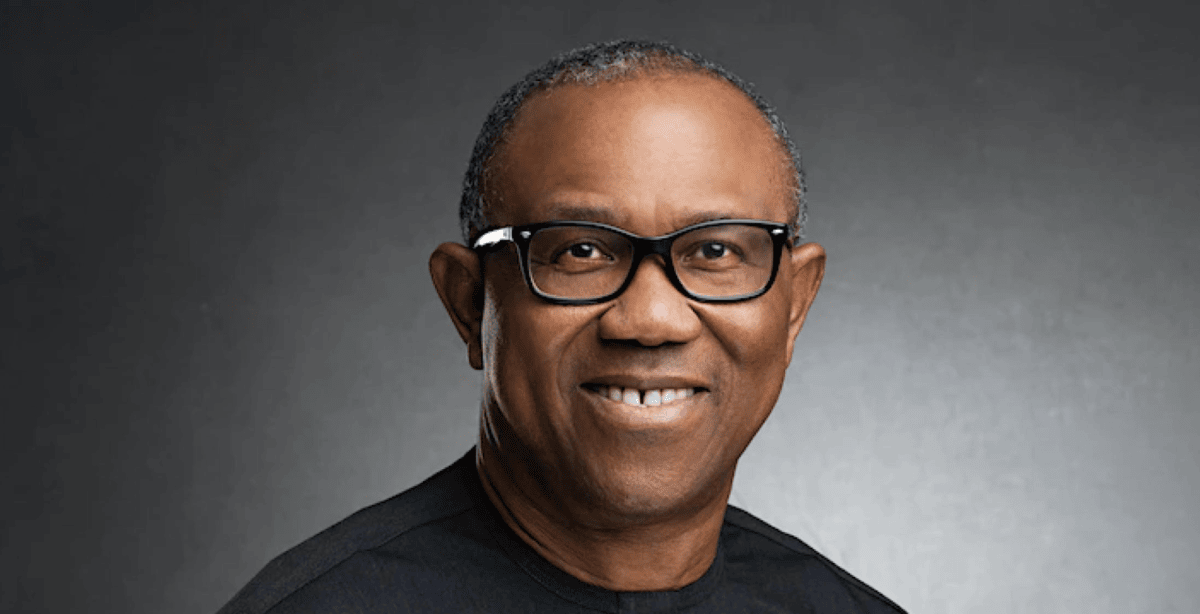

Speaking on the development, Usoro Usoro, Executive Director, Strategy and Stakeholder Management at MoMo PSB, said: “Through our partnerships with Lightway Finance and Thunes, we have strengthened our international payments infrastructure to support both outbound and inbound remittances across key corridors. This expansion reflects our commitment to building secure, scalable, and inclusive financial solutions that meet the evolving needs of our customers.”

By widening both sending and receiving corridors, MoMo PSB continues to deepen access to financial services and strengthen Nigeria’s connection to the global economy, making international payments more accessible, affordable, and seamless for individuals and businesses alike.