FG to inject N500bn in FMBN

The Federal Government plans to inject N500 billion ($1.4 billion) in its low-cost mortgage lender over the next five years in an effort to spur home ownership.

Faced with a housing deficit of 17 million units, Nigeria is seeking to improve access to home loans in an economy that vies with South Africa as the continent’s biggest.

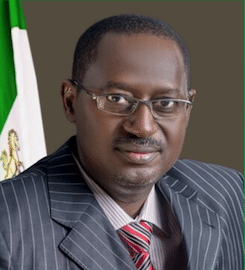

Chief Executive Officer, Federal Mortgage Bank of Nigeria (FMBN), Ahmed Musa Dangiwa said lack of proper land deeds, poverty and record high interest rates means there are only an estimated 50,000 registered mortgages, of which state-owned FMBN accounts for 18,200.

The FMBN boss who stated this in an interview in Abuja, recently noted that the mortgage institution is seeking to boost its capital from N5 billion at a rate of N100 billion a year.

According to him, the FMBN is expecting proposals on its recapitalisation, as well as a reorganisation of its business, to be approved by all arms of government by the end of 2018.

He said the company’s current capital base is “grossly inadequate, that’s why we’re in the process of ensuring that the capital base be increased.”

Dangiwa explained that armed with the extra cash, the institution can go from the 2,500 new mortgages it plans to sign up this year to 100,000 over the next two years, noting that the extra capital will also encourage other investors to provide additional funding.