Why directors’ investments are low in banks

Investigations into how well some of Nigerian Bank directors believe in their organization has revealed that quite a number of them have surprisingly low stakes in the banks they head, leaving investors to wonder how ready, they truly are in improving the fortunes of these organizations.

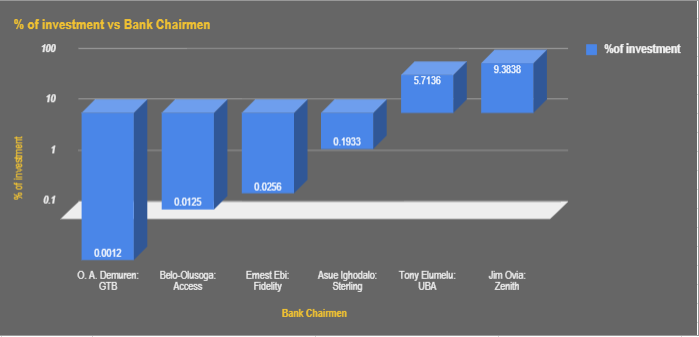

In analyzing the financial positions of six of Nigeria’s bank chairmen, namely, Access Bank, Fidelity Bank, Guaranty Trust Bank, Sterling Bank, United Bank for Africa and Zenith Bank, for the period ended 30th June 2017.

DAILY TIMES gathered that none of the chairmen of each of the bank had more than 6 per cent stake in their respective companies except for two.

Guaranty Trust Bank’s Osaretin A Demuren had the lowest stake of all the Chairmen of the Board of Directors with less than 0.001 per cent.

Her direct and indirect shareholding as at 30th June 2017, amounted to 356,581 units worth about N13.7million, given GTB’s 7th September’s share price of N38.54 per share.

Following her closely, was Access Bank’s Belo Olusoga with 0.013 per cent in the company. Total holdings amounted to 3.6m units valued at N34.6m, with Access’ share price of N9.6 as at 7th September 2017.

Although the choice of investment is altogether personal, the only regulatory inhibition for owning shares in listed companies dictated by the Securities and Exchange Commission (SEC) is that one person (single individual) may not own more than 10 per cent stake in any given listed company.

Meanwhile, further, checks revealed that Fidelity Bank’s Chairman, Ernest Ebi has an investment in Fidelity worth about N10m.

His stake in the company as at 30 June 2017, stood at 0.03 per cent; and Sterling Bank’s Asue Ighodalo owned 0.2 per cent stake with his investment worth N56.8m.

Speaking with our capital market correspondent, a financial analyst and capital market expert wondered why the investments by directors in their respective firms were so low.

According to him, the level of investment a director has in a company shows you the level of interest he/she has in that organization.

“When you see a director buying a lot of shares about a company, it says a lot about the company. It shows that they are ready to work and give their best to the organization.”

“In this part, we don’t take this kind of things of seriously, but it will be advisable if the regulatory authorities can encourage the directors to invest more in their companies.

It will send the right signals to especially local investors and further strengthen Nigeria’s capital market.” He said

The DAILY TIMES findings, however, revealed that United Bank for Africa’s (UBA) Tony Elumelu is one of the top two directors who have a significant measure of investment in the bank at 5.7 per cent.

Elumelu’s combined direct and indirect holdings as at 30th June 2017 stood at 2.1bn units valued at N18.3bn as at 7th September 2017.

The top bank director with the highest stake in his business is Zenith Bank’s Jim Ovia with a whopping 9.4 per cent equity stake. Ovia’s total holdings stand at 2.95bn units valued at almost N70bn as at 7th September as well.

A more deep seated saying suggests that passion is easily identified in situations with high stakes involved and issues with high stakes are also more likely to involve powerful emotions and strong impulses to action.

Even though most stocks have been analysed by market experts as trading below their intrinsic values, a welcome step towards further boosting investor confidence could be at the fingertips of these companies, if actions by their directors point investors towards a brighter path for corporate, economic and national development.

Afolabi Adesola