Detty December: Is Nigeria’s Aviation Sector Ready for the Year-End Surge?

Last Year’s Aviation Performance Numbers Set the Baseline

Official data from the Nigeria Civil Aviation Authority (NCAA) shows that Nigeria handled about 15.6 million air passengers in 2024, reflecting a slight decline from the previous year. Domestic passenger traffic accounted for roughly 11.5 million, while international passenger movements rose to approximately 4.1–4.3 million, driven largely by Lagos and Abuja airports.

While domestic travel softened due to high fares and weakened consumer purchasing power, international arrivals showed resilience, signalling the growing importance of diaspora and inbound travel, particularly during the Christmas period. This divergence has shaped expectations for this year’s Detty December, with industry operators projecting stronger international inflows despite continued domestic capacity constraints.

International Inflows and the Domestic Connection Test

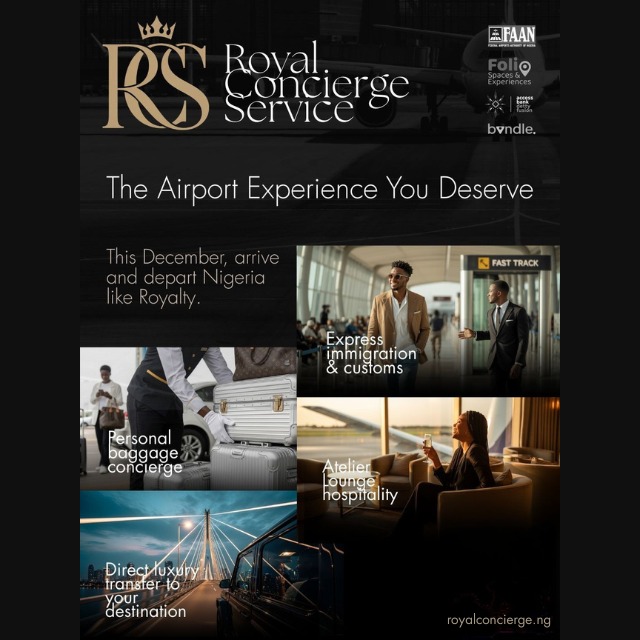

December remains the busiest period for inbound international travel into Nigeria. Airlines serving Europe, North America and the Middle East typically operate at near-full capacity, especially into Lagos. The concentration of arrivals at a few international gateways places intense pressure on immigration processing, baggage handling and customs clearance.

According to Akin Oladipo, a veteran aviation analyst, “The success of Detty December is no longer just about getting passengers into Nigeria. It’s about how efficiently they are moved through the system and connected to domestic destinations. Any misalignment can create a ripple effect across the entire aviation network.”

However, the bigger test begins after arrival. A large proportion of international passengers rely on local airlines for onward connections to destinations such as Owerri, Uyo, Benin, Asaba, Calabar and Port Harcourt. This places Nigeria’s domestic aviation network at the heart of the Detty December challenge.

Local Airlines: Capacity, Fleet and Scheduling Constraints

Nigeria’s local airlines enter the peak season with limited room for manoeuvre. Fewer than 35 serviceable aircraft support scheduled domestic operations nationwide, leaving little buffer for disruptions. Although airlines typically increase frequencies on high-demand routes such as Lagos–Abuja during December, secondary routes remain thinly served.

Fleet utilisation during the festive season often approaches regulatory limits. Any unscheduled maintenance event can trigger a chain reaction of delays and cancellations. Foreign exchange pressures further complicate readiness, as aircraft maintenance, spare parts and leasing costs remain dollar-denominated.

Industry expert Ngozi Eke, a former airline operations manager, said: “Most local carriers are already operating at near-max capacity. The festive surge will stretch them further, and without additional aircraft or strategic scheduling, passengers will face delays and missed connections.”

Missed Connections and Passenger Experience Risks

The lack of coordinated scheduling between international arrivals and domestic departures remains a major weakness. Many long-haul international flights arrive late at night or early in the morning, while domestic services operate within narrower time windows.

Passengers frequently face missed connections, overnight delays and additional accommodation costs. For diaspora Nigerians returning home for Christmas and first-time visitors attending Detty December events, these disruptions shape broader perceptions of Nigeria’s transport infrastructure and service efficiency.

Airport Readiness and Transfer Efficiency

Nigeria’s major airports have seen incremental upgrades, but transfer efficiency remains limited. International-to-domestic connections are largely manual, requiring passengers to navigate separate terminals, repeated security checks and long queues.

Secondary international airports remain underutilised, forcing most Christmas arrivals through Lagos and Abuja and intensifying congestion. A more balanced use of regional gateways could ease pressure on domestic connections and improve overall system resilience.

Impact on the Nation’s Transport Sector

The surge in passenger traffic during Detty December places additional pressure on Nigeria’s broader transport ecosystem. Airports alone cannot manage the festive influx; roads, taxis, buses, ride-hailing services and urban traffic systems all feel the ripple effects. Congestion at key urban arteries leading to airports can delay passengers and increase travel costs, while overstretched public and private transport providers must scale operations rapidly to meet demand.

Rail services, where operational, also face higher passenger volumes, highlighting gaps in multimodal connectivity and integration with air travel. Ports of entry for ground transportation become bottlenecks, particularly for travellers moving from airports to hotels, entertainment venues, or regional destinations.

This increased demand drives temporary employment and revenue for road transport operators but also exposes infrastructure weaknesses, including poorly maintained roads and limited traffic management systems. Over time, repeated seasonal pressure can accelerate wear and tear on urban transport networks, raising maintenance costs for government and private operators alike.

Transport economist Dr Samuel Igbokwe said, “The aviation sector cannot be viewed in isolation. Peak season traffic spills into road and rail networks. Without proper integration, efficiency is compromised, and costs rise for everyone—from passengers to service operators.”

In addition, the rise in domestic and international air arrivals stimulates demand for ancillary logistics services, such as cargo and shuttle operations, but insufficient planning risks operational inefficiencies, missed connections, and higher operational costs. Ultimately, the seasonal spike tests the resilience and capacity of Nigeria’s entire transport sector, reinforcing the need for coordinated planning between aviation authorities, transport agencies, and urban management bodies.

Airfares, Costs and Economic Spillovers

Airfares typically spike sharply during December. Domestic ticket prices often double on high-demand routes, reflecting limited capacity and high operating costs. While higher fares help airlines manage rising expenses, they also restrict access for middle-income travellers.

Economically, this concentrates Detty December benefits in a few urban centres, particularly Lagos, while states dependent on domestic air access risk losing tourism-related revenue.

Safety, Weather and Operational Risk

Regulators have reiterated that safety will not be compromised for commercial gain. Crew duty limits and aircraft utilisation rules constrain operational expansion during peak demand. Harmattan weather conditions further increase the risk of delays, particularly for early-morning arrivals and departures.

Expectations for This Year’s Detty December

Compared with last year, industry stakeholders expect stronger international passenger volumes this festive season, supported by improved global travel confidence and Nigeria’s growing profile as a December tourism hub. However, domestic capacity has not expanded at the same pace, raising concerns that pressure points observed in 2024 may intensify.

Managing the Surge, Not Yet Optimising It

Nigeria’s aviation sector is better prepared than it was five years ago, but the Detty December surge continues to expose structural weaknesses. Local airlines are managing demand under pressure rather than operating within a fully optimised network.

Until fleet sizes increase, airport transfer processes improve, and domestic schedules are better aligned with international arrivals, December will remain a seasonal stress test for Detty.

For now, Nigeria’s aviation industry appears capable of coping with the festive rush. But as international arrivals continue to rise year-on-year, the sector’s ability to deliver reliable domestic connections will determine whether Detty December evolves into a scalable economic opportunity or remains a recurring logistical challenge.