12 Listed Firms Declare N117.86bn Interim Dividend For Shareholders

Twelve listed companies on the Nigerian Exchange (NGX) have rewarded shareholders with interim dividends totalling N117.86 billion for the half-year ended June 30, 2025, underscoring solid earnings performance across key sectors.

Leading the pack, Seplat Energy declared N41.61 billion, representing N70.71 per share, in line with its consistent dividend policy. Okomu Oil followed with N28.62 billion, or N30 per share, while Presco Plc proposed N20 billion at N20 per share. Transcorp Power also announced an interim payout of N11.25 billion, translating to N1.50 per share.

Other dividend declarations include United Capital (30 kobo per share, N5.40 billion), Transnational Corporation (40 kobo, N4.07 billion), Unilever Nigeria (50 kobo, N2.87 billion), Custodian Investment (25 kobo, N1.47 billion), Consolidated Hallmark Holdings (10 kobo, N400 million), Africa Prudential (10 kobo, N400 million), and Ikeja Hotel (N0.03 per share, N64.87 million).

Market analysts say the strong payouts reflect both profitability and a commitment to shareholder value, a factor that typically enhances investor confidence and attracts income-focused buyers. Analysts also note that attractive dividends can push companies into the premium investment class on the exchange.

Vice-Chairman of Highcap Securities Limited, Mr David Adonri, described the interim dividends as “quite impressive,” noting that while they signal strong financial health, they should be viewed as a prelude to the final dividend, which ultimately measures the true return to investors. He added that interim payouts have contributed significantly to equities market growth in 2025.

Senior stockbroker, Mr Charles Fakrogha, said dividend declarations should be based on sound financials and not merely as a tradition. “When a company declares interim dividends, it implies a willingness to distribute a portion of its earnings. This is beneficial as it provides investors with immediate returns and reinforces trust in management,” he explained.

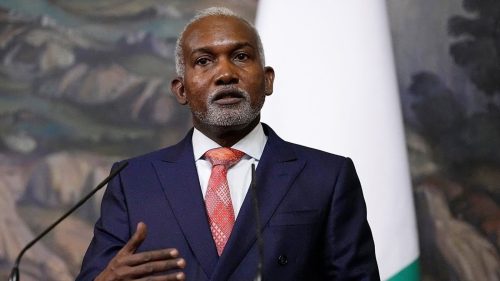

Seplat’s chief executive officer, Mr Roger Brown, reaffirmed the company’s strong fundamentals, noting that production volumes remained robust in the second quarter of 2025. “Our focus on integrity, reliability, and production improvement activities is bearing fruit, with offshore production growing 11 per cent quarter on quarter,” he said.

With interim dividends already crossing N117.86 billion, market watchers expect stronger final payouts at year-end, particularly if listed firms sustain their earnings trajectory in the second half of 2025.